Art auction sales at major auction houses Christie’s, Sotheby’s, and Phillips are expected to decline in May compared to last year. According to ArtTactic, the total sales for the next two weeks are projected to reach $1.2 billion, which is an 18% decrease from the previous year and nearly half of the total for the May 2022 sales. This decline follows a recent downturn in the art market since its peak after the Covid-19 pandemic. The combination of cheap money, a booming stock market, and fiscal stimulus led to record-breaking sales during that time. However, in 2021, global auctions of fine art fell by 27% compared to 2022, marking the first contraction since the start of the pandemic. The average price also dropped by 32%, representing the largest decline in seven years.

Art auction sales at major auction houses Christie’s, Sotheby’s, and Phillips are expected to decline in May compared to last year. According to ArtTactic, the total sales for the next two weeks are projected to reach $1.2 billion, which is an 18% decrease from the previous year and nearly half of the total for the May 2022 sales. This decline follows a recent downturn in the art market since its peak after the Covid-19 pandemic. The combination of cheap money, a booming stock market, and fiscal stimulus led to record-breaking sales during that time. However, in 2021, global auctions of fine art fell by 27% compared to 2022, marking the first contraction since the start of the pandemic. The average price also dropped by 32%, representing the largest decline in seven years.

The contemporary and postwar category, which has been a significant driver of growth in the art market in recent years, experienced a sharp decline of 48% in sales during the first quarter of this year, according to ArtTactic. The auction houses attribute this decline to a lack of supply rather than a decrease in demand. Collectors are holding back on selling their artworks in anticipation of a more favorable market environment. Additionally, there are no major single-owner collections available for sale this spring, such as the Macklowe Collection or Paul Allen Collections, which had fueled previous sales.

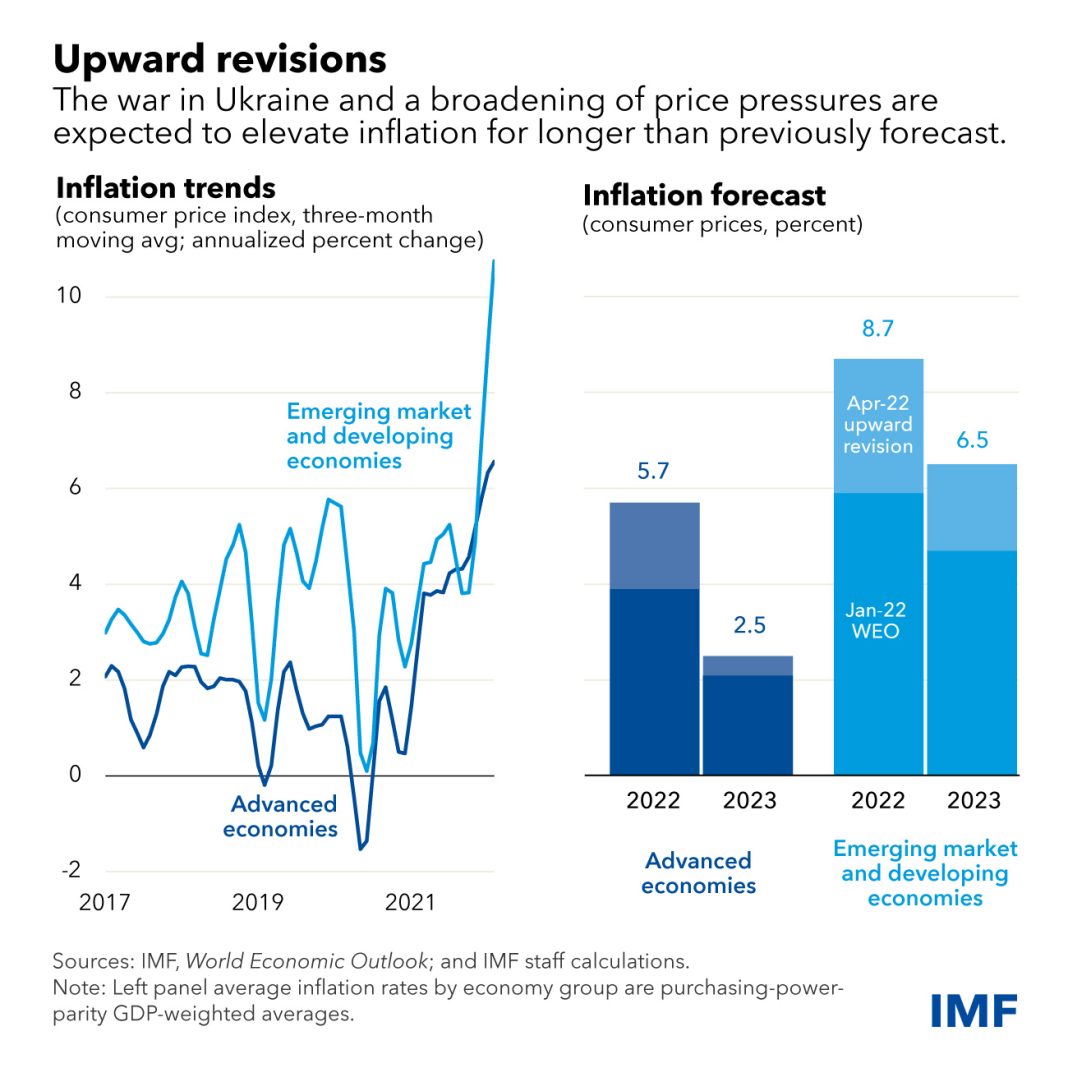

Dealers and art experts point out that the auction art market is currently stalled due to pricing issues. Sellers are not willing to accept lower prices than what they could have obtained during the peak of the market in 2021-2022. On the other hand, buyers are demanding discounts due to concerns about rising interest rates, an uncertain election year, and geopolitical uncertainty. This has created a stalemate in negotiations, with sellers wanting 20% more and buyers demanding 20% less, according to Philip Hoffman, CEO of the Fine Art Group.

Buyers today lack the confidence they had a few years ago due to persistent inflation, higher interest rates, fears of a slowing economy, upcoming elections, and geopolitical crises. These factors have caused many collectors to pause their art purchases. Andrew Fabricant, the chief operating officer at Gagosian, a prominent gallery and dealership, highlights that the current situation with the Federal Reserve and the relatively higher cost of money compared to previous years has contributed to buyer hesitation.

Moreover, the scarcity of top-level art available for auction has further dampened buyers’ enthusiasm. While previous spring sales featured more than a dozen works offered for over $30 million each, this year’s offerings are limited. The most expensive works this season include Francis Bacon’s “Portrait of George Dyer Crouching” from 1966, estimated to sell for $30 million to $50 million at Sotheby’s. Sotheby’s also has a collection of four paintings by Joan Mitchell, with two expected to fetch over $15 million. Christie’s is featuring a large work by Brice Marden called “Event” and an iconic piece by Jean-Michel Basquiat titled “The Italian Version of Popeye Has No Pork In His Diet,” both estimated at $30 million.

Despite the challenges in the auction market, art experts suggest that now may be a good time for buyers to seek bargains. Hoffman believes that buying at pre-2022 prices and investing in high-quality artworks could yield favorable long-term returns. Although auction sales have weakened, sales in private markets and galleries remain strong. Sales of new works in galleries are less dependent on investment returns and are therefore less susceptible to economic and stock market volatility. The auction houses have also experienced growth in their private sales, where they facilitate direct deals between buyers and sellers without a public auction.

Selling artworks privately carries less risk of a failed auction, which can negatively impact the value of a work. The private market allows for targeted approaches to potential buyers and greater flexibility in pricing. Drew Watson, head of art services at Bank of America, emphasizes the discretion and ability to adjust prices based on market feedback when engaging in private sales.

In conclusion, the May art sales at major auction houses are expected to decrease compared to last year as the art market continues to experience a decline from its post-Covid peak. Pricing issues and a lack of supply have contributed to a stalemate in negotiations between sellers and buyers. However, art experts believe that now may be a favorable time for buyers to hunt for bargains. While auction sales have weakened, sales in private markets and galleries remain robust. The private market offers more targeted approaches to buyers and greater flexibility in pricing, reducing the risk of a failed auction.