Housing Market Slows Down as Pending Home Sales Drop

Housing Market Slows Down as Pending Home Sales Drop

Pending home sales in the United States fell 7.7% in April compared to the previous month, marking the slowest pace since April 2020, according to the National Association of Realtors. These pending sales serve as a forward-looking indicator of closed sales that typically occur one to two months later. Furthermore, pending sales were 7.4% lower than in April of the previous year.

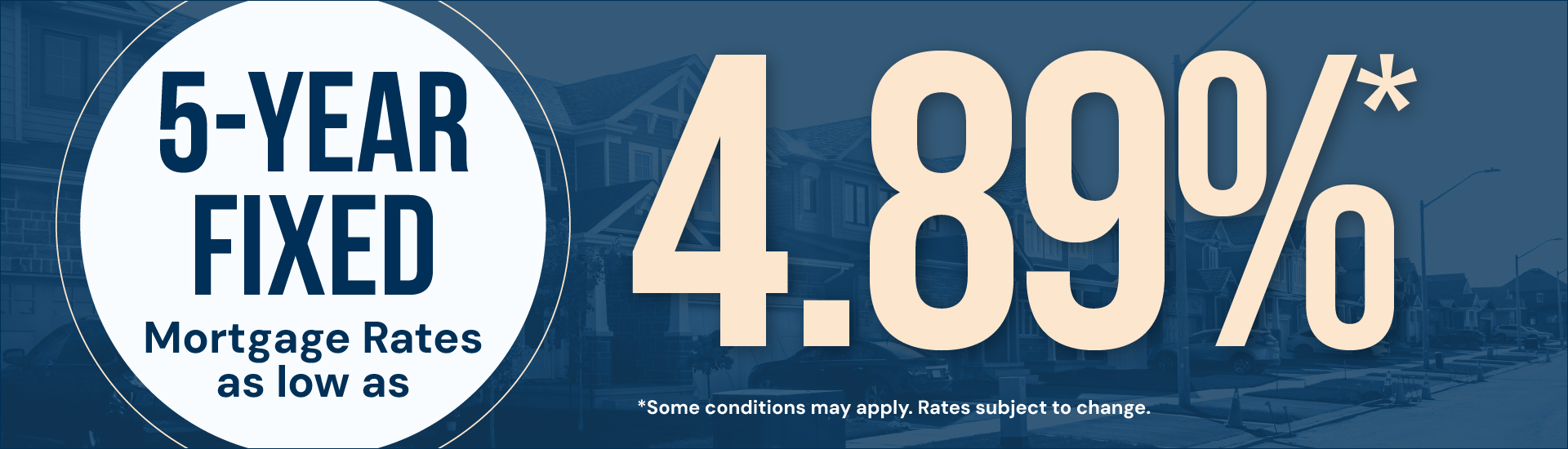

The drop in sales came as a surprise, as experts had expected sales to remain flat compared to March. The decline can be attributed to buyers’ reactions to rising mortgage rates. Mortgage News Daily reported that the average rate on a 30-year fixed mortgage rose from around 6.9% at the end of March to 7.5% by the end of April.

The impact of escalating interest rates, combined with soaring home prices and limited supply, has had a significant effect on the housing market. Lawrence Yun, the chief economist for the National Association of Realtors, stated that the increase in rates dampened home buying activity in April, despite there being more inventory available. However, Yun remains optimistic, citing the anticipated rate cut by the Federal Reserve later in the year, which is expected to improve affordability and increase supply.

The decline in sales was observed across all regions of the country, with the Midwest and West experiencing the sharpest drops. These regions are characterized by a mix of affordable and expensive housing markets, respectively. Yun emphasized that measurable home price declines are unlikely in most markets. However, regions experiencing price declines may present second-chance opportunities for buyers if job growth continues.

In response to the sluggish sales pace in April, sellers have started to lower their prices. Redfin reported that 6.4% of sellers reduced their asking prices in May, marking the highest level since 2022. Additionally, the median asking price dropped for the first time in six months.

Despite the slowdown in sales, there is some optimism for the summer market. Active inventory in April was 30% higher compared to the same period in 2023, indicating a potentially more active market this year. However, Hannah Jones, a senior economic research analyst with Realtor.com, emphasized that lower mortgage rates will be crucial in attracting both buyers and sellers back into the market.

In conclusion, the housing market experienced a decline in pending home sales in April, signaling a slowdown in closed sales for the coming months. Rising mortgage rates, combined with high home prices and limited supply, have deterred potential buyers. However, experts remain hopeful that an anticipated rate cut by the Federal Reserve will improve conditions and bring more affordability and supply to the market. Sellers have already begun reducing their prices, and an increase in active inventory suggests a potentially more active summer market. Lower mortgage rates will play a vital role in revitalizing the housing market and attracting buyers and sellers alike.