Apple device users will soon have the option to use Affirm’s buy now, pay later (BNPL) loans for their purchases. This partnership between Apple and Affirm is a positive development for both companies and the BNPL sector as a whole. When Apple introduced its own BNPL product last year, there were concerns that it would overshadow standalone providers like Affirm. However, Apple’s decision to allow Affirm products in its ecosystem suggests that Affirm has something unique to offer.

Apple device users will soon have the option to use Affirm’s buy now, pay later (BNPL) loans for their purchases. This partnership between Apple and Affirm is a positive development for both companies and the BNPL sector as a whole. When Apple introduced its own BNPL product last year, there were concerns that it would overshadow standalone providers like Affirm. However, Apple’s decision to allow Affirm products in its ecosystem suggests that Affirm has something unique to offer.

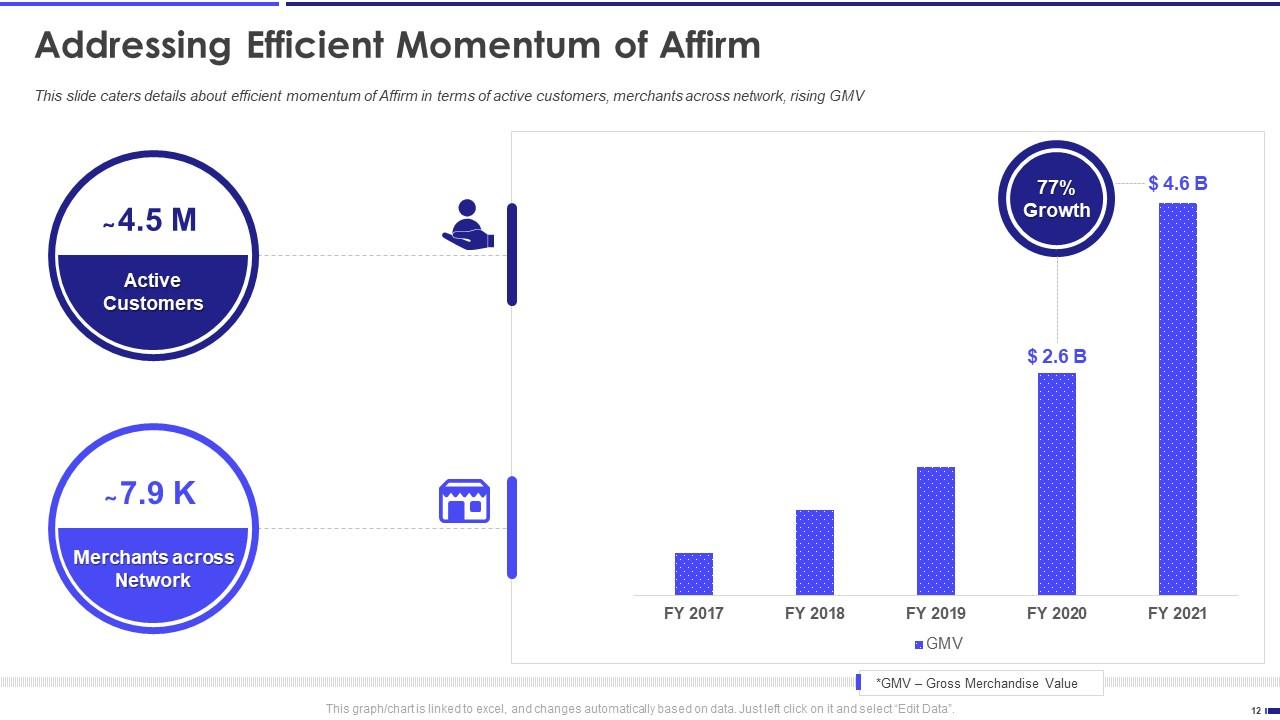

One advantage of Affirm over Apple’s BNPL loan is the range of longer-term offerings it provides. While Apple’s loan allows users to repay purchases in four installments over six weeks, Affirm offers more flexibility with repayment terms that can extend over a year or more. This distinction highlights the strength of Affirm’s brand and its sophisticated underwriting technology, which sets it apart from Apple.

Apple also announced that installment loans via credit and debit cards will be available on Apple Pay in the U.S. through partnerships with Citigroup, Synchrony, and Fiserv-related issuers. Traditional credit card players have started offering BNPL-style installment loans due to their increased popularity during the COVID-19 pandemic.

The partnership with Apple is a significant opportunity for Affirm to expand its user base. With over 500 million users worldwide and a leading market share in the U.S., Apple Pay has a wide reach and a strong presence in the mobile payment and digital wallet space. This integration will allow Affirm to tap into this large customer base and potentially increase its revenue.

Despite the positive news, Affirm stated that it does not expect the partnership with Apple to have a significant impact on its revenue or gross merchandise volume until fiscal year 2025. However, this doesn’t dampen the excitement surrounding the deal, as evidenced by the rise in Affirm’s stock after the announcement.

In conclusion, the collaboration between Apple and Affirm is a win-win situation. It provides Apple device users with more payment options and combines the security and convenience of Apple Pay with the flexibility and transparency of Affirm. Moreover, it showcases the strength of Affirm’s brand and its ability to offer unique features that differentiate it from other BNPL providers. With the inclusion of traditional credit card players in Apple Pay’s installment loan offerings, the BNPL sector continues to expand, catering to the evolving needs of consumers.