China’s Stock Market: A Closer Look at the Recent Slump

Since the beginning of 2024, China’s stock market has been in the spotlight due to debt defaults and a housing market crash. However, there seems to be a discrepancy between the economic data and the reality on the ground. Despite a reported GDP growth of 5.2 percent, there is double-digit unemployment and a series of debt defaults. Surprisingly, the market has not been affected by this artificial data or false news. Additionally, the government has taken the unprecedented step of banning stock sales, indicating the severity of the situation.

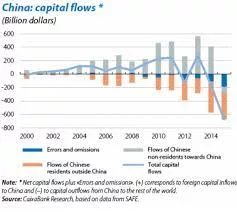

The Capital Flight Phenomenon

The recent slump in China’s stock market appears to be more related to capital fleeing rather than macro or fundamental factors. On paper, the macro figures are not worse than those during the COVID-19 pandemic. For example, the Purchasing Managers’ Index (PMI) has remained around 50, which is an improvement compared to the lows of 40 during the pandemic. The export sector has also shown signs of improvement, with verifiable trade partner records. However, despite these positive indicators, the Shanghai stock index is now as bad as it was during the spring of 2020.

Reasons for Capital Flight

While political tension with the rest of the world may be a contributing factor, it is unlikely to be the main reason for capital flight from China. This tension has existed since the trade war with the U.S. in 2018. Although the Shanghai Composite Index experienced a significant decline in 2018, it recovered in 2020. Most emerging markets are inherently risky, yet they still attract Western investors. Therefore, a cyclical bust alone cannot explain the massive capital outflow. There must be some structural or institutional changes at play.

Structural and Institutional Changes

Structurally, China is undergoing significant changes. It is no longer experiencing population growth but rather a decline. It is also no longer the world’s leading factory producing goods on a massive scale. Real estate, which was previously a booming sector, is now undergoing deleveraging. These macroeconomic changes have resulted in a secular bear stock market, as evidenced by the stagnant index since 2007. It is likely that a new secular downtrend has begun since 2021, although this has yet to be confirmed.

Japan provides an interesting comparison to China in terms of stock market trends. The two countries’ stock indexes showed a strong correlation from 2001 to 2021. Prior to that, Japan experienced a decline while China’s stock market was on the rise. Now, the situation has reversed, with China’s stock market facing significant challenges.

The Institutional Factor

In addition to structural changes, there is an institutional factor at play in China. The country is currently experiencing severe infighting as the ruling regime tries to maintain its power. To President Xi Jinping, the elimination of the wealthy capitalist class is crucial for the Chinese Communist Party (CCP). This institutional change has had a profound impact on the market, leading to a massive outflow of capital that shows no signs of returning.

By KC Law, Ka Chung