Measuring the Investment Horizon of Stock Funds: A Comprehensive Guide

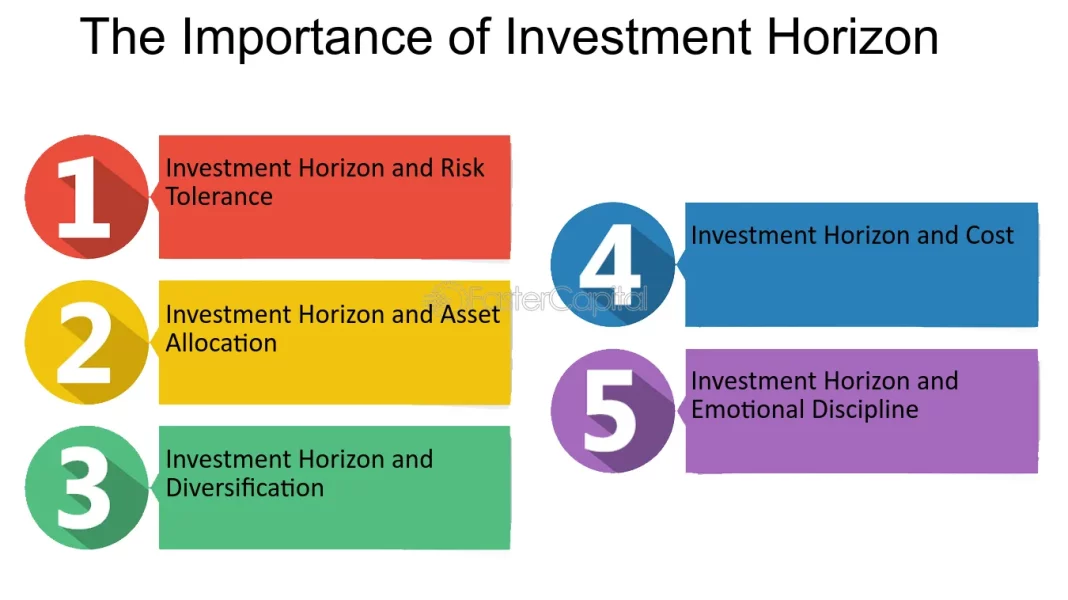

When it comes to investing in stock funds, understanding the investment horizon is crucial for making informed decisions. The investment horizon refers to the length of time an investor plans to hold a particular investment before selling it. This article aims to provide a comprehensive guide on measuring the investment horizon of stock funds, helping investors optimize their strategies and achieve their financial goals.

Defining the Investment Horizon:

The investment horizon is a key factor in determining the risk and return potential of stock funds. It can range from short-term (less than a year) to medium-term (1-5 years) or long-term (5+ years). Identifying your investment horizon is essential as it influences the choice of stocks, asset allocation, and overall portfolio management.

Factors Influencing Investment Horizon:

Several factors influence an investor’s investment horizon, including financial goals, risk tolerance, age, and market conditions. Younger investors with longer time horizons may be more inclined towards aggressive growth strategies, while older investors nearing retirement may prefer a more conservative approach.

Aligning Investment Horizon with Financial Goals:

To measure your investment horizon accurately, it is essential to align it with your financial goals. Short-term goals like saving for a down payment on a house may require a shorter investment horizon, while long-term goals like retirement planning may necessitate a longer investment horizon.

Evaluating Risk and Return Potential:

The investment horizon plays a significant role in assessing the risk and return potential of stock funds. Generally, longer investment horizons allow investors to ride out market fluctuations and potentially benefit from compounding returns. However, shorter investment horizons may require a more cautious approach to mitigate potential losses.

Diversification and Asset Allocation:

Measuring the investment horizon also involves considering diversification and asset allocation strategies. Diversifying investments across different sectors and asset classes can help mitigate risk and optimize returns over the investment horizon. Asset allocation should be periodically reviewed to ensure it aligns with the desired investment horizon and risk tolerance.

Monitoring and Adjusting:

Investors should regularly monitor their stock fund investments and make adjustments as needed. Market conditions, economic factors, and personal circumstances may warrant a reassessment of the investment horizon. Staying informed and seeking professional advice can help investors make informed decisions.

Conclusion:

Measuring the investment horizon of stock funds is crucial for optimizing investment strategies and achieving financial goals. By understanding the factors influencing the investment horizon, aligning it with financial objectives, evaluating risk and return potential, and implementing diversification and asset allocation strategies, investors can make informed decisions to maximize their investment returns. Regular monitoring and adjustments are essential to ensure the investment horizon remains aligned with changing market conditions and personal circumstances.