Interest charges on the federal budget continue to be a significant burden for the United States. In August, the U.S. budget deficit reached $1.9 trillion, with one more month left in the fiscal year. This surge in deficit was primarily driven by the weight of interest charges. The federal government reported a deficit of $380 billion in August, the largest monthly shortfall since September 2022. This stands in stark contrast to the $89 billion surplus reported in August 2023. These figures align with the findings of the Congressional Budget Office (CBO) in its latest Monthly Budget Review.

The Treasury Department highlighted that August has historically been a month with deficits, as there are no major tax due dates during this period. In terms of revenues, there was an 8 percent year-over-year increase, totaling $306.54 billion. On the expenditure side, outlays also increased by approximately 8 percent, reaching $686 billion.

For the first 11 months of the 2024 fiscal year, the federal deficit amounted to $1.897 trillion, a 24 percent increase compared to the same period in the previous year. However, the CBO noted that this shortfall would have been approximately $302 billion larger if not for certain payment shifts and deferred tax accounting.

Looking at the 12-month rolling deficit from September 2023 to August 2024, it amounted to about $2.1 trillion. It is anticipated that next month’s Treasury data will reveal a budget shortfall exceeding the CBO’s upwardly adjusted forecast of a $1.9 trillion federal deficit for fiscal year 2024.

Examining the top budgetary items for the fiscal year to date, Social Security takes the lead with $1.337 trillion, followed by Medicare ($850 billion), health ($824 billion), and national defense ($798 billion). Notably, interest charges have consistently posed a significant strain on the federal budget. In the current fiscal year, interest charges, both gross and net, rank as the second-largest budgetary item, reaching nearly $1.05 trillion last month. The Treasury Department estimates that interest payments will surpass $1.157 trillion.

This year, the U.S. government’s interest payments have accounted for 48 percent of individual income tax collections. Torsten Slok, the chief economist at Apollo Wealth Management, highlights that the average daily interest expense is $3 billion. If the Federal Reserve were to cut interest rates by 1 percent, daily interest charges would decrease to $2.5 billion.

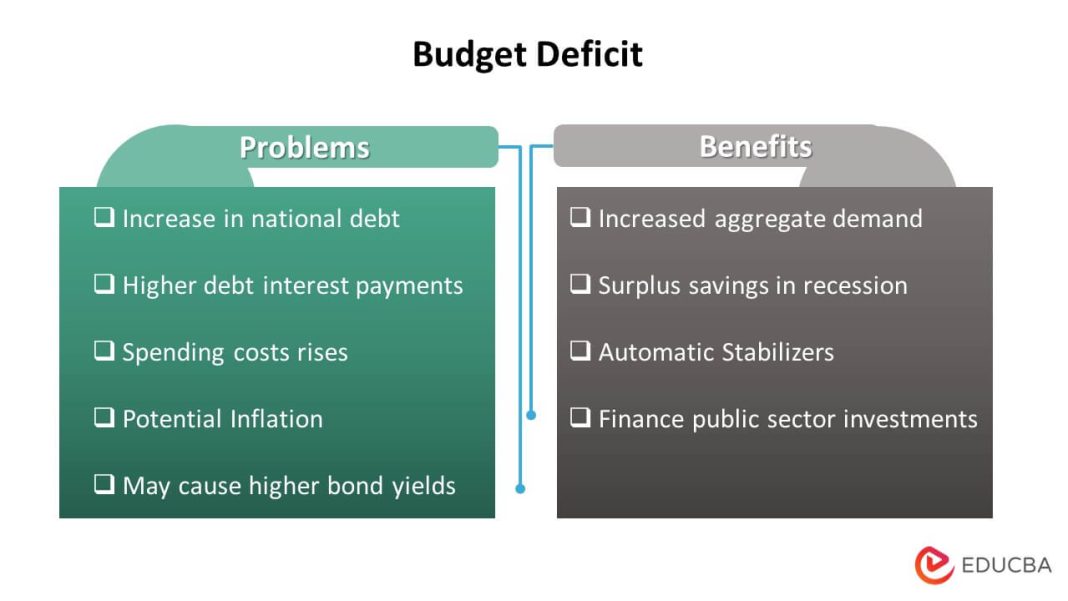

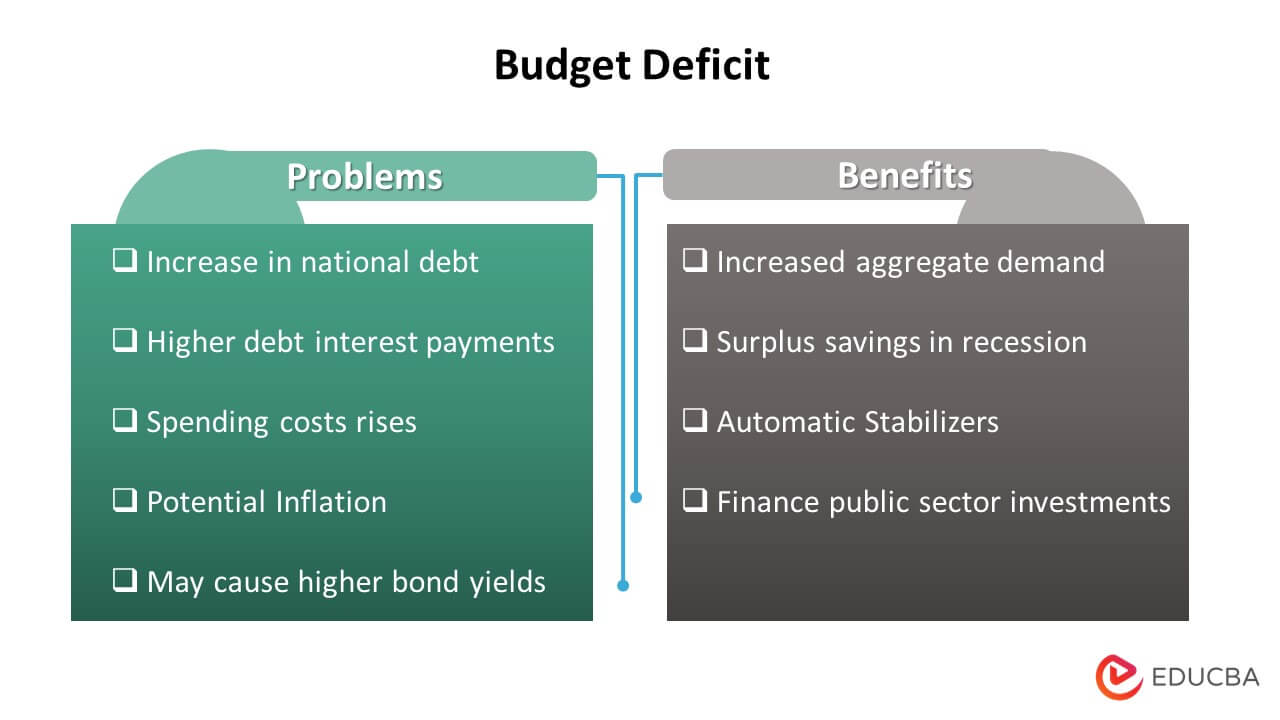

As of September 11, the national debt stands at $35.331 trillion, having increased by approximately $1.34 trillion since the beginning of the year. The CBO projected in June that the national debt will surpass $50 trillion in the next 10 years. This projection is driven by growing deficits, higher net interest payments, and increased mandatory spending.

The ING strategists assert that government finances have been significantly impacted by the massive fiscal transfers from the public sector to the private sector during the pandemic, under the presidencies of both Trump and Biden. They note that even if the candidates were genuinely motivated to reduce the deficit, there are structural challenges that make it difficult to control expenditure.

Maya MacGuineas, the president of the Committee for a Responsible Federal Budget, argues that neither of the U.S. presidential nominees for the 2024 election has adequately addressed the nation’s mounting debt. MacGuineas emphasizes that the next president must confront this issue honestly and inform the public about the threats posed by the debt and the necessary steps to address it. However, during the September 10 presidential debate, the record national debt and escalating federal deficit were not discussed.