Revised Capital Requirement Hike for U.S. Banks Slashed by Federal Reserve

In a recent speech at the Brookings Institution in Washington, Michael Barr, the vice chair for supervision at the Federal Reserve, announced a significant reduction in the proposed capital requirement increase for large U.S. banks. This revision comes after facing opposition from the banking industry and political figures from both sides of the aisle.

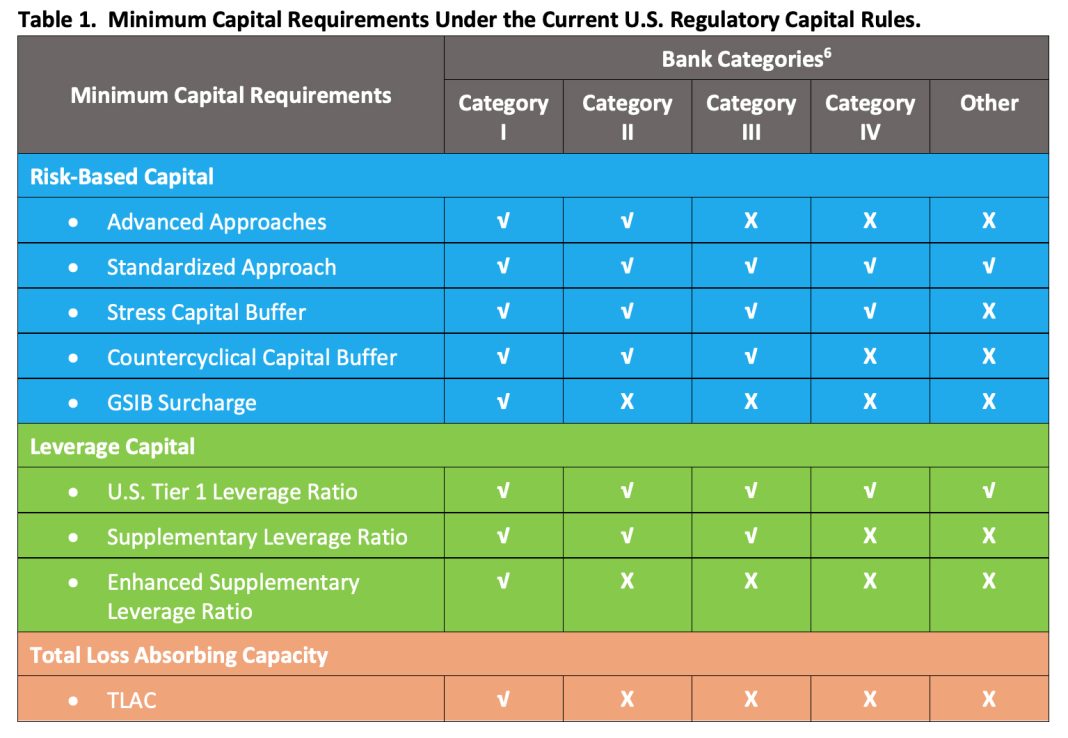

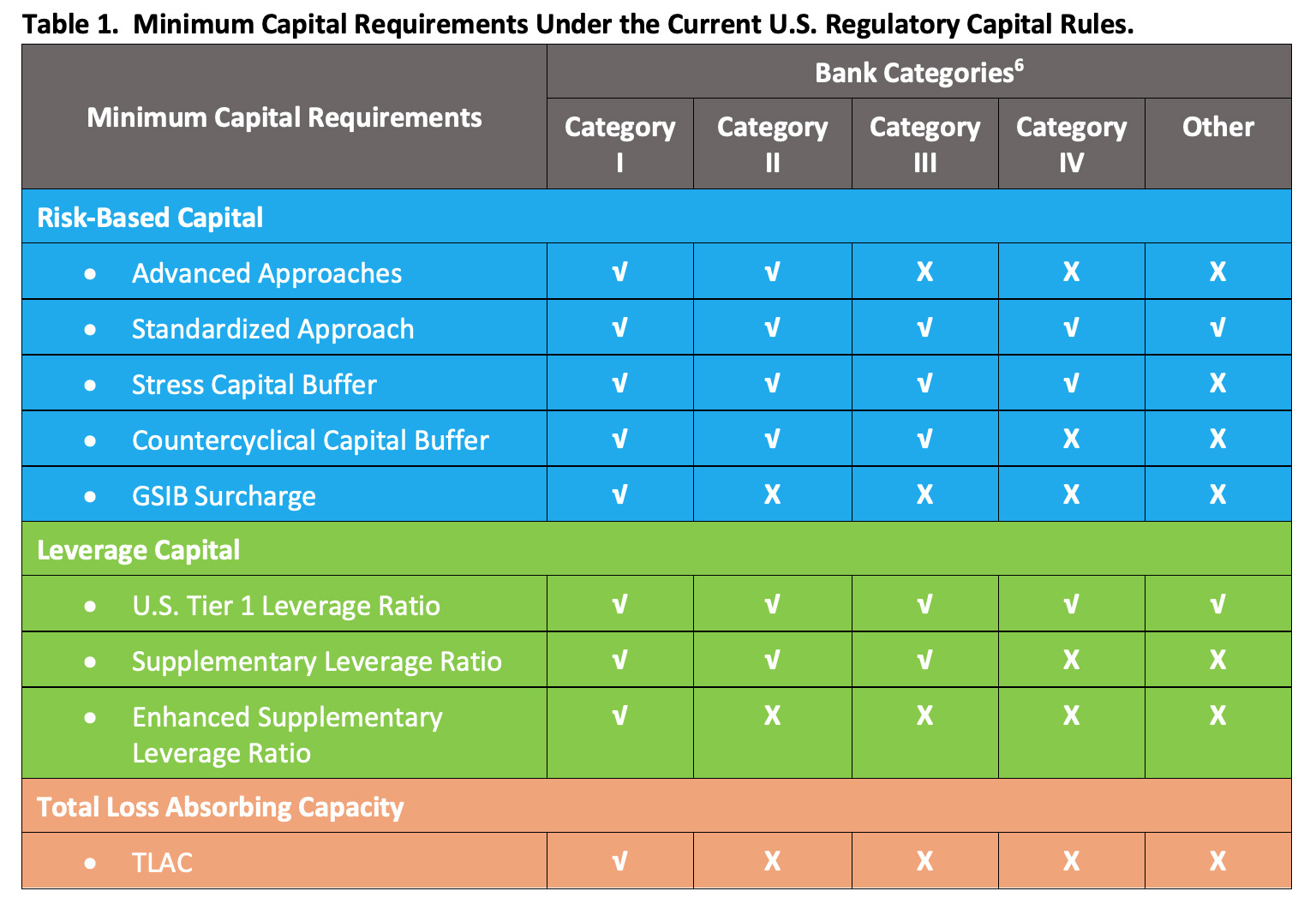

The original proposal aimed to increase the capital requirement for the nation’s biggest lenders, with the goal of strengthening the banking sector’s resilience against future financial crises. The Federal Reserve, along with other regulatory bodies, has been pushing for these new rules as part of a global effort to make banks more resilient after the 2008 global financial crisis.

However, after months of lobbying, debate, and public comment, the Fed has decided to scale back the scope of the original proposal. Under the new plan, banks with assets between $100 billion and $250 billion will be largely excluded from the capital hikes. This is a major concession to industry concerns. The only change for these banks is that they will now have to account for unrealized gains and losses on their securities as part of their regulatory capital. This adjustment aims to better reflect the different risk profiles of banks.

For the largest and most complex institutions, known as global systemically important banks (G-SIBs), the revised proposal would raise their common equity Tier 1 capital requirement by 9 percent. This is a significant reduction from the previously proposed 19 percent. The eight G-SIBs in the United States had nearly $1 trillion in common equity Tier 1 capital at the end of June. Therefore, the reduced capital requirement means they will have to collectively boost their buffer by around $90 billion instead of the original proposal’s $190 billion.

While the banking industry welcomes the reduction in the capital requirement, there is still uncertainty regarding the details of the re-proposal. Daniel Pinto, President of JPMorgan Chase, stated that they would closely examine the revised plan once the Federal Reserve releases a detailed version. Brian Moynihan, CEO of Bank of America, expressed his belief that there is no need for banks like his to hoard more rainy-day capital. He argued that increasing capital requirements by 10 percent would prevent them from making loans that could benefit small businesses and middle-market companies.

Under the revised proposal, other large U.S. banks with significant assets (between $250 billion and $700 billion) will see their capital affected mostly through the inclusion of unrealized gains and losses on securities. This will result in an increase in their capital buffer of around 3 percent to 4 percent. Smaller non-G-SIB firms will experience a modest increase of 0.5 percent in their capital requirement.

The original proposal faced opposition not only from the banking industry but also from Democrats and Republicans. Critics argued that the increased capital requirements would lead to higher borrowing costs, making it difficult for aspiring homebuyers and potential business owners to access loans.

In conclusion, the Federal Reserve’s decision to slash the proposed capital requirement hike for big U.S. banks comes after significant industry opposition. The revised plan reflects a balance between the need to strengthen the banking sector’s resilience and the concerns raised by the banking industry and political figures. While the revised proposal reduces the burden on some banks, there is still uncertainty surrounding the specific details and potential impacts. The debate over capital requirements continues, with stakeholders emphasizing the importance of maintaining access to credit for individuals and businesses.