Berkshire Hathaway, the holding company led by legendary investor Warren Buffett, reached a significant milestone in its market value on August 28th. The conglomerate briefly surpassed $1 trillion, becoming the first non-tech firm in the United States to achieve this feat. This accomplishment occurred just two days before Buffett’s 94th birthday, adding to the significance of the moment.

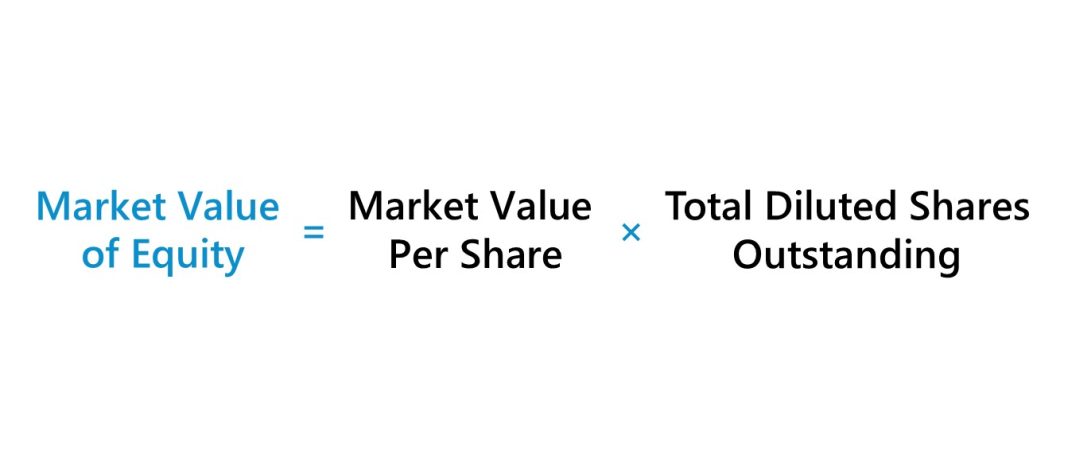

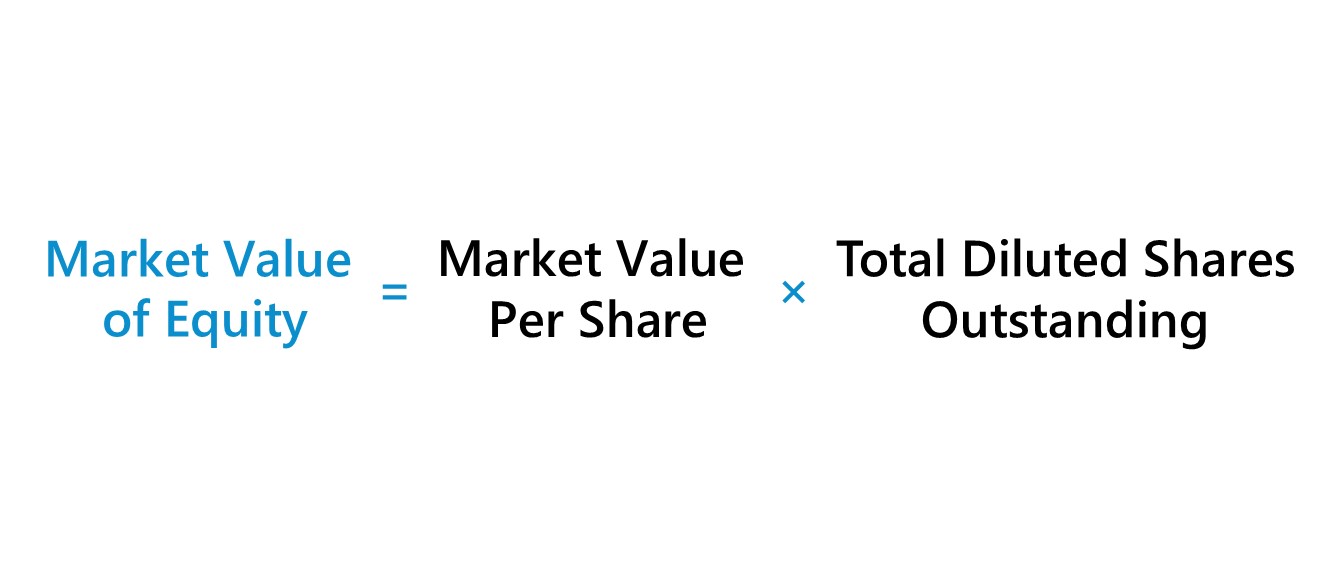

Berkshire Hathaway joined an elite group of companies that have crossed the $1 trillion threshold, including Apple, Nvidia, Microsoft, Google parent Alphabet, Amazon, and Facebook parent Meta Platforms. However, it’s important to note that Berkshire Hathaway’s valuation is based on the outstanding shares as of July 23rd, which included 553,234 Class A shares and 1,325,192,508 Class B shares. The Class A shares were trading at $696,502, while the Class B shares were valued at $464.59 at the end of August 28th.

Although the market cap dipped below $1 trillion at the time of writing, Berkshire Hathaway temporarily became the only publicly traded non-tech firm, excluding Saudi Aramco, to surpass this valuation milestone. It’s worth mentioning that the conglomerate’s valuation still falls short of that of software company Nvidia and tech giant Microsoft, both of which are valued at over $3 trillion.

Warren Buffett, often referred to as the “Oracle of Omaha,” has been the driving force behind Berkshire Hathaway since 1965. Under his leadership, the company has transformed from a small textile business into one of the most valuable firms globally. Buffett’s long-term value investing strategy has allowed him to amass a fortune of approximately $146 billion, making him the sixth-richest person in the world, according to Forbes.

The remarkable success of Berkshire Hathaway’s shares is evident in the staggering growth they have experienced since Buffett took over. Over the years, the shares have gained more than 5,600,000 percent, resulting in an average annual gain of around 20 percent—almost double the annualized gain of the S&P 500 Index, including dividends. Furthermore, the stock has risen by 27 percent this year, outperforming the S&P 500’s 18 percent gain.

Berkshire Hathaway’s portfolio boasts an impressive array of companies across various sectors. The conglomerate wholly owns or controls a majority of voting shares in numerous businesses, including American Express, Bank of America, Business Wire, Dairy Queen, Kraft Heinz, and Coca-Cola. Collectively, these companies generated $22.8 billion in profit during the first half of the year, marking a 26 percent increase compared to the previous year.

While Berkshire Hathaway has slowed down its stock repurchases this year, it has engaged in a stock-selling spree in recent months. Notably, it has sold significant amounts of Apple stock—one of its largest holdings—as well as Bank of America stock. In the past week alone, the company unloaded nearly 25 million shares of Bank of America, amounting to almost $1 billion. As a result, Berkshire Hathaway has accumulated substantial cash reserves, with holdings of cash and equivalents reaching $276.9 billion as of June 30th, primarily in U.S. Treasury bills.

Despite his charitable endeavors, Buffett remains a major shareholder in Berkshire Hathaway, owning more than 14 percent of the company. Since 2006, he has donated over half of his shares to charity and has pledged to transfer nearly all of his multibillion-dollar fortune into a charitable trust managed by his three children upon his passing.

In conclusion, Berkshire Hathaway’s brief achievement of surpassing $1 trillion in market value highlights the remarkable success of Warren Buffett’s leadership and the long-term value investing strategy that has propelled the conglomerate to its current position. As one of the most valuable firms globally, Berkshire Hathaway’s diverse portfolio of companies continues to generate substantial profits. Despite its recent stock-selling spree, the company has amassed significant cash reserves, reflecting its sound financial position. The influence of Warren Buffett and his commitment to philanthropy further contribute to the conglomerate’s reputation and long-term prospects.