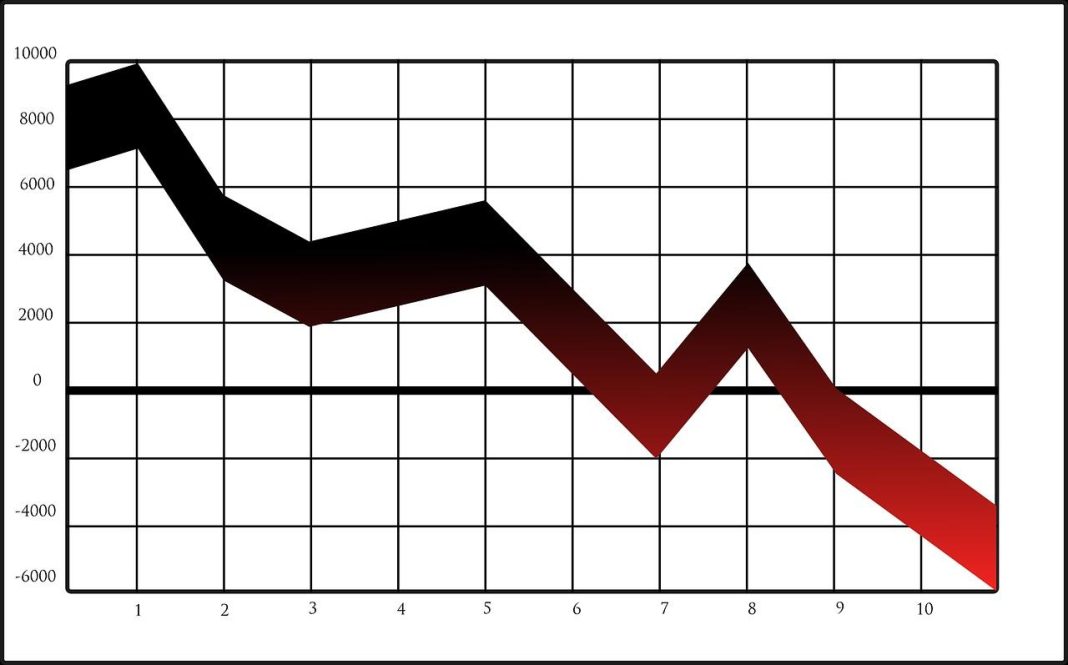

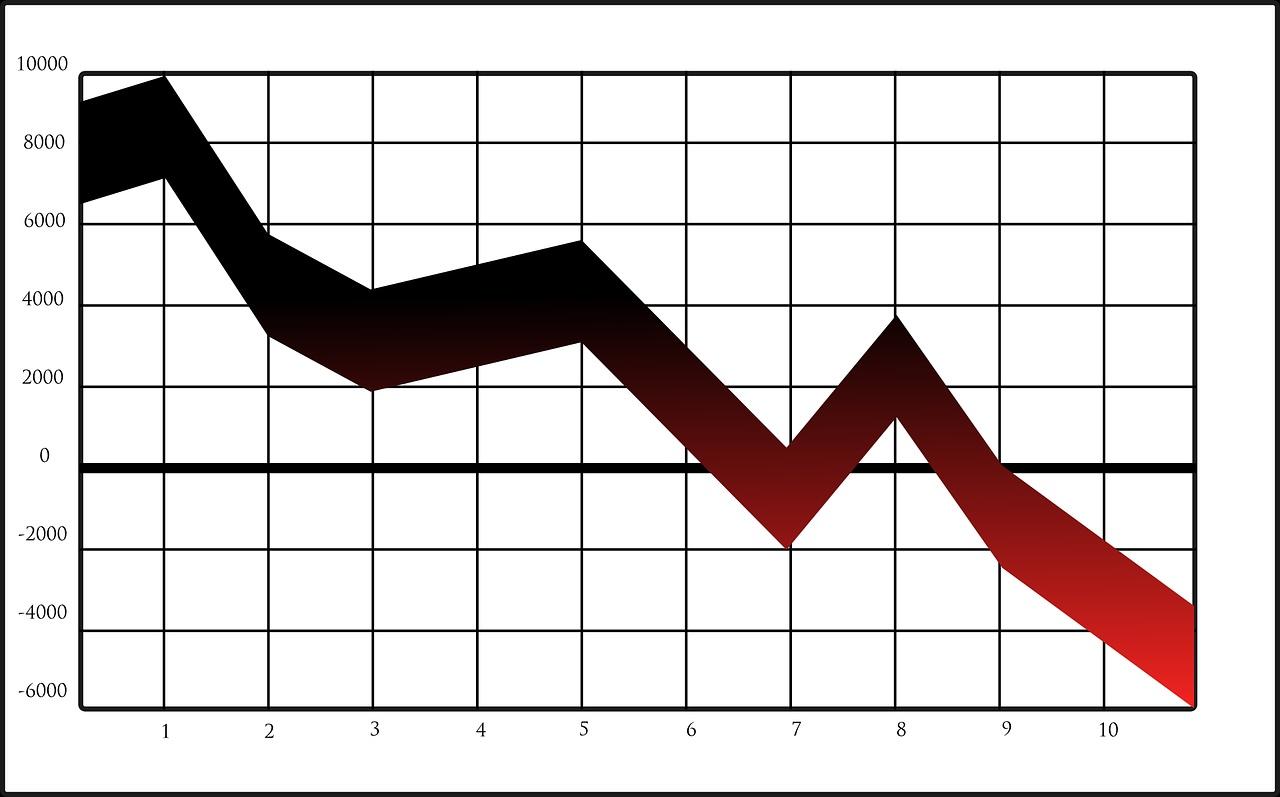

Private jet flights have experienced a 15% decline in the first half of 2024 compared to their peak in 2022. This decrease can be attributed to a combination of waning demand and increased competition in the high-end travel industry. Despite a brief surge in flights during the Summer Olympics, where a record 713 private jet flights were recorded to Paris in the last week of July, the industry continues to struggle. According to data from Argus International, private jet charter flights dropped to 610,000 in the first half of the year, down from 645,000 last year and 716,000 in 2022.

Private jet flights have experienced a 15% decline in the first half of 2024 compared to their peak in 2022. This decrease can be attributed to a combination of waning demand and increased competition in the high-end travel industry. Despite a brief surge in flights during the Summer Olympics, where a record 713 private jet flights were recorded to Paris in the last week of July, the industry continues to struggle. According to data from Argus International, private jet charter flights dropped to 610,000 in the first half of the year, down from 645,000 last year and 716,000 in 2022.

The decline in private jet travel can be attributed to a correction in the private aviation market, as the initial surge of new jet card members and charter fliers who began traveling privately during the Covid-19 pandemic begins to subside. Even ultra-wealthy travelers are showing signs of spending fatigue. This challenges the assumption that once people experience flying private, they would never go back to commercial flights. Many individuals who tried private jet travel for the first time have returned to commercial flights.

While the industry is still performing better than in 2019, experts predict that the current decline in private jet flights is setting the stage for a shakeout. The post-Covid boom in the industry led to a wave of IPOs, startups, and a rush to acquire jets and pilots. However, this expansion is not sustainable, and some companies are already facing significant financial challenges. For example, Wheels Up, which went public in 2021, saw its stock plummet before receiving an investment and partnership from Delta Air Lines. The company reported a net loss of $97 million in the second quarter of 2024, along with a decline in members.

The challenges faced by private aviation companies can be traced back to the impact of the Covid-19 pandemic. In 2020, private jets offered a safer way to travel when airports and airlines shut down. Wealthy travelers who had previously been reluctant to fly privately due to cost and environmental concerns now had a reason to justify the expense. This led to a significant increase in demand for private jet travel.

Additionally, the influx of liquidity from government spending, stimulus packages, low interest rates, and a booming stock market resulted in record levels of wealth, which allowed individuals to afford the high costs of private jet travel. Companies rushed to purchase planes, hire pilots, and attract new members. The number of private jet charters exceeding 100,000 per month became the norm in 2021, with July 2021 recording over 300,000 flights.

However, the rapid increase in demand overwhelmed the industry. Operators struggled to acquire or lease planes fast enough, leading to delays and cancellations for passengers who had paid significant amounts for their flights. Shortages of pilots and parts further compounded the challenges faced by the industry.

In 2023, demand for private jet travel began to decline as more planes and pilots entered the market. Some wealthy fliers felt they could no longer use the pandemic as an excuse to fly privately, while others found the prices to be prohibitive. The increased costs of flying private, which were approximately 20% higher than in 2019, led many individuals to set a limit on how much they were willing to spend.

In response to the decline in demand, some individuals started flying commercial for city-to-city trips, mixing both commercial and private travel throughout the year. A survey conducted by Private Jet Card Comparisons found that 87% of private jet fliers switch between airlines and private jet travel depending on their destination.

As a result of lower demand, unsold planes are accumulating, and prices are beginning to soften. The number of used business jets for sale increased by 17% in July compared to the previous year, while prices fell by 7%. Despite this, orders for new jets remain strong, although the wait times have decreased from three to four years to approximately two years for many models.

Industry executives view the drop in demand as a positive development, as it brings the industry back to a more balanced equilibrium. Profitable routes, available planes, and satisfied customers are seen as signs of a more sustainable long-term path for the private aviation industry.

While occasional fliers may have shifted away from private aviation, heavy users continue to fly privately. According to Private Jet Card Comparisons’ survey, 95% of individuals who started flying privately during the pandemic are still flying privately, with 77% enrolled in a membership, jet card, or fractional program.

Companies like NetJets, owned by Berkshire Hathaway, have benefited from the shift from charter to fractional ownership due to improved reliability and quality. The number of fractional flights increased by 12% in the first half of 2024.

Overall, the decline in private jet flights can be attributed to a combination of factors, including a correction in the market, spending fatigue among travelers, and the increase in prices. While the industry is still performing better than in 2019, the current challenges highlight the need for a more sustainable approach to private aviation.