Title: The Loper Bright Case and the Future of Estate Planning: A Post-Chevron Doctrine Analysis

Title: The Loper Bright Case and the Future of Estate Planning: A Post-Chevron Doctrine Analysis

Introduction:

In 1984, the Chevron doctrine established the practice of relying on agencies’ decisions for interpreting laws when Congress provided no explicit instructions. However, the recent Loper Bright case has set aside the Chevron doctrine, allowing courts to interpret ambiguous laws themselves. This decision has significant implications for estate planning and trust cases, prompting the need for more precise language in legislation and potential limitations on tax-planning strategies. Estate planners must adapt to these changes by creating personalized documents that align with evolving laws.

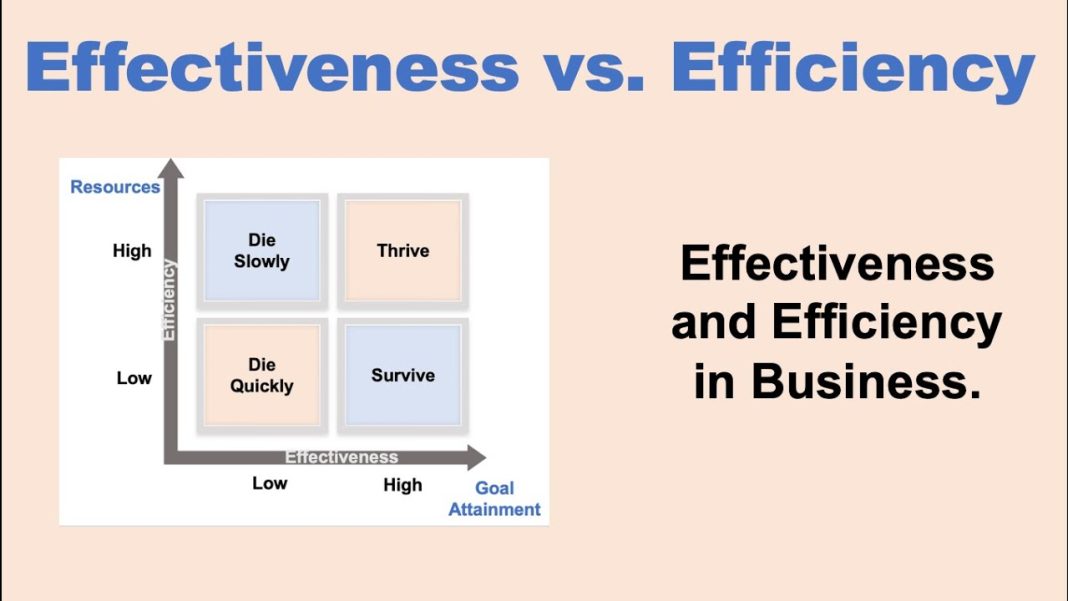

Courts Granted Interpretive Authority:

By removing the Chevron doctrine, courts now have the liberty to interpret imprecise or ambiguous laws. This newfound interpretive authority will lead to variations in how regulations are understood and applied. Consequently, the estate planning and tax industry will face challenges as the interpretations of laws evolve.

Impact on Previous Cases:

Although the Chevron doctrine has been set aside, Chief Justice John Roberts clarified that previous cases would not be automatically reviewed. Merely citing the Chevron doctrine as the basis for a past decision does not warrant a retrial. However, the removal of the doctrine opens the door for new cases that challenge previous court decisions made under non-specific laws.

Precise Language and Limitations:

The elimination of the Chevron doctrine necessitates more precise language in new laws to minimize reinterpretation due to language ambiguities. Additionally, governmental agencies responsible for clarifying meanings must have clear limitations on their authority. These changes will result in estate planners facing more restrictions and a heightened need to stay updated on the latest laws.

Impact on Tax Laws:

The removal of the Chevron doctrine may lead to slower changes in tax laws and their application. Existing laws may require clarifications, while new laws will demand more detailed provisions. Court cases related to tax laws will now require an examination of the accuracy of the IRS’s interpretation of Congress’s tax laws. If a court finds an ambiguous IRS regulation to be unreasonable, it may choose not to enforce it.

Revising Estate-Planning Documents:

Individuals who believed their estate plans were immune to legal challenges must now confront the possibility of their documents being declared ineffective in posthumous court cases. To ensure their documents align with changing laws, it is crucial for everyone to have their estate-planning attorney evaluate and potentially revise their documents periodically.

The Stare Decisis Principle:

The legal principle of stare decisis, which mandates that similar cases receive treatment consistent with previous decisions, helps maintain a uniform and predictable legal process. This principle provides reassurance that estate planning cases will be handled in a manner consistent with earlier rulings.

The Need for Personalized Plans:

The Loper Bright case will likely prompt estate planners to create documents that precisely cater to their clients’ needs. Standard package plans may no longer suffice, and estate planners must be meticulous in ensuring their documents align with evolving estate planning laws.

Conclusion:

The removal of the Chevron doctrine in the Loper Bright case has reshaped the landscape of estate planning. Courts now possess the authority to interpret ambiguous laws, necessitating more precise language in legislation. This change brings challenges to the estate planning and tax industry, demanding adaptability and a thorough understanding of evolving laws. Individuals with existing wills and trusts should consult with their attorneys to ensure their documents are prepared to withstand potential challenges. The epoch-making Loper Bright case serves as a reminder of the need for periodic reviews and updates to estate-planning documents in light of changing personal circumstances and evolving legal frameworks.