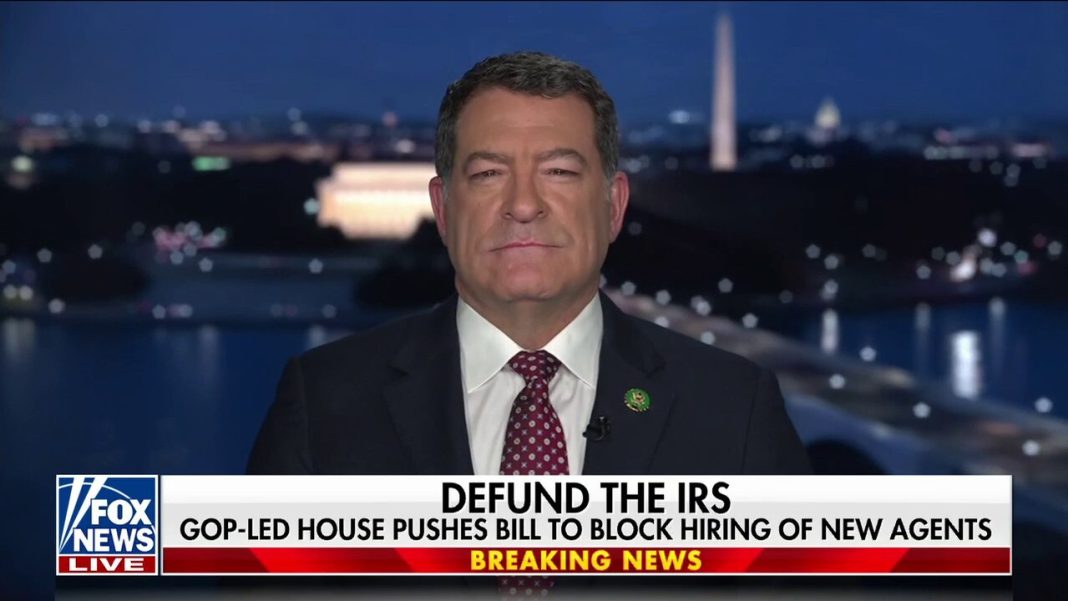

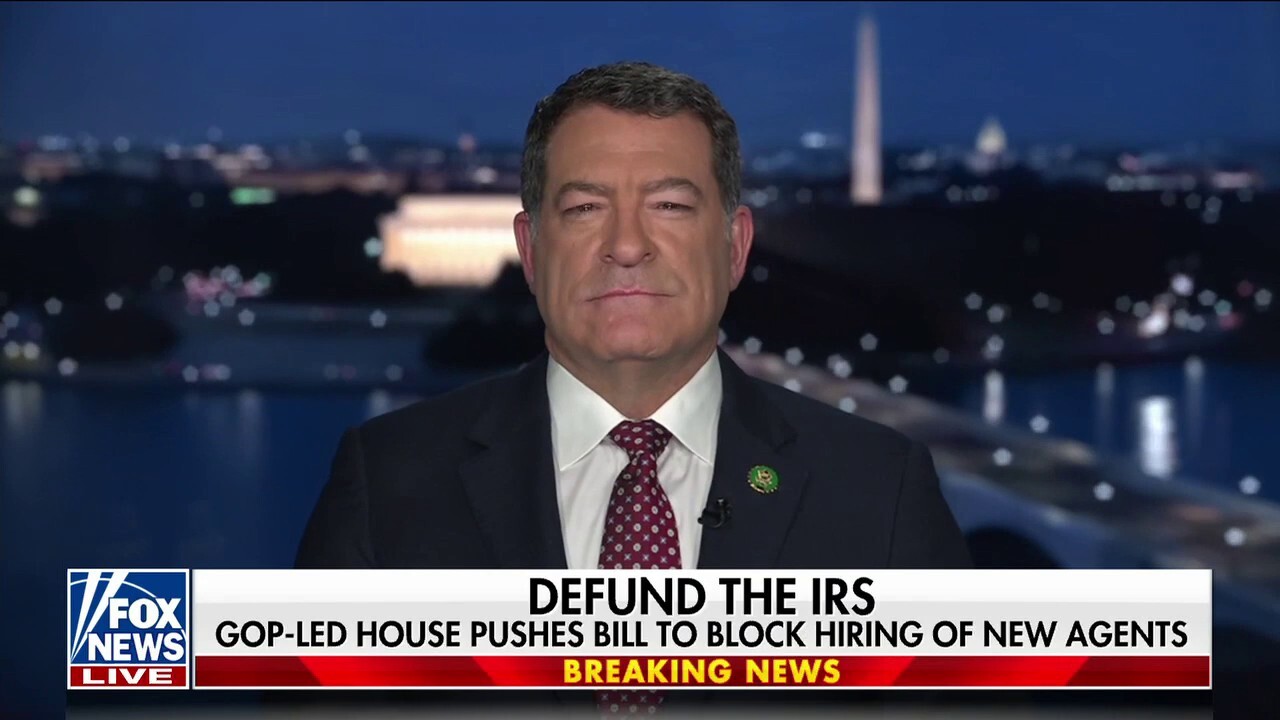

on President Trump’s tax plan reveal that one of the major changes proposed is the elimination of taxes on tips. This move is expected to have a significant impact on the working class, providing them with more take-home pay and potentially stimulating economic growth.

on President Trump’s tax plan reveal that one of the major changes proposed is the elimination of taxes on tips. This move is expected to have a significant impact on the working class, providing them with more take-home pay and potentially stimulating economic growth.

Under the current tax system, tips are considered taxable income, subject to both federal and state taxes. This means that hardworking individuals in service industries such as restaurants and hospitality have to report and pay taxes on their tips. However, President Trump aims to change this by completely removing taxes on tips.

This proposal has garnered support from various groups, including those representing workers in the service industry. They argue that eliminating taxes on tips will provide a much-needed boost to the working class, allowing them to keep more of their hard-earned money. Additionally, this policy change could incentivize individuals to work in service-oriented jobs, leading to increased employment opportunities within these industries.

Critics, on the other hand, raise concerns about the potential loss of tax revenue if tips are no longer taxed. They argue that this could create a shortfall in government funds, which could impact public services and infrastructure projects. However, proponents of the plan argue that the potential economic growth resulting from increased consumer spending by individuals with more disposable income could offset any loss in tax revenue.

The impact of this proposed change goes beyond just the working class. It has the potential to reshape the dynamics of the service industry as well. For example, studies have shown that tipping culture can perpetuate income inequality, with certain groups receiving larger tips than others. By eliminating taxes on tips, this disparity may be reduced, creating a fairer system for all workers in the industry.

Moreover, the removal of taxes on tips aligns with President Trump’s broader goal of simplifying the tax code and reducing the burden on American workers. By reducing the amount of paperwork and calculations required for reporting tips, individuals in service industries can save time and effort, allowing them to focus more on their work.

In conclusion, President Trump’s plan to eliminate taxes on tips has the potential to be a significant boon for the working class. This policy change could provide individuals in service industries with more take-home pay, stimulate economic growth, and create a fairer system for all workers. While there are concerns about potential loss in tax revenue, the overall benefits of this proposal cannot be overlooked. By simplifying the tax code and reducing the burden on workers, President Trump aims to create an environment that promotes economic prosperity and individual financial stability.