Labor Market Cooling: Rising Unemployment Claims Indicate Potential Fed Rate Cut

Labor Market Cooling: Rising Unemployment Claims Indicate Potential Fed Rate Cut

Introduction:

The number of U.S. workers collecting unemployment benefits has reached its highest level since 2021, signaling a cooling labor market as the Federal Reserve considers interest rate cuts. Continuing jobless claims rose to 1.87 million for the week ending July 6, the highest level since November 2021. Analysts view this increase as a sign of a softer job market, potentially leading to a rate cut by the Fed.

Impact of High Interest Rates:

High interest rates have a cooling effect on spending and demand as borrowing becomes more expensive. This reduction in consumer spending causes businesses to scale back their investment and hiring efforts, resulting in a weakened job market. Given that the Fed raised rates rapidly due to high inflation in 2022, reaching their current range of 5.25 percent to 5.5 percent, the last time rates were at a comparable level was 23 years ago.

Federal Reserve’s Concerns:

Federal Reserve Chair Jerome Powell has testified before Congress, stating that labor market conditions have significantly cooled since the rate-hiking cycle began two years ago. This acknowledgment by Fed officials indicates their growing wariness of potential risks in the labor market. With the labor market softening, the Fed is contemplating when to implement rate cuts.

Unemployment Filings and Labor Market Dynamics:

Data from the Labor Department reveals that first-time unemployment filings for the week ending July 13 increased by 20,000 compared to the previous week, surpassing analysts’ expectations. Weekly jobless claims have been steadily rising since the start of the year, as indicated by the four-week moving average. While some economists interpret this data as evidence of a softening labor market, they do not believe it signifies a more profound breakdown.

The Labor Market Outlook:

Chief economist at consulting firm Ernst & Young, Gregory Daco, suggests that the labor market is cooling rather than retrenching. However, economists are closely monitoring labor market dynamics due to the current high interest rate environment, which dampens inflation and economic activity, including hiring. Economist Mohamed El-Erian highlights the importance of determining whether the recent increase in jobless claims is mere noise or an indication of a more rapid loss of momentum in economic growth.

Unemployment Rate and Recession Signals:

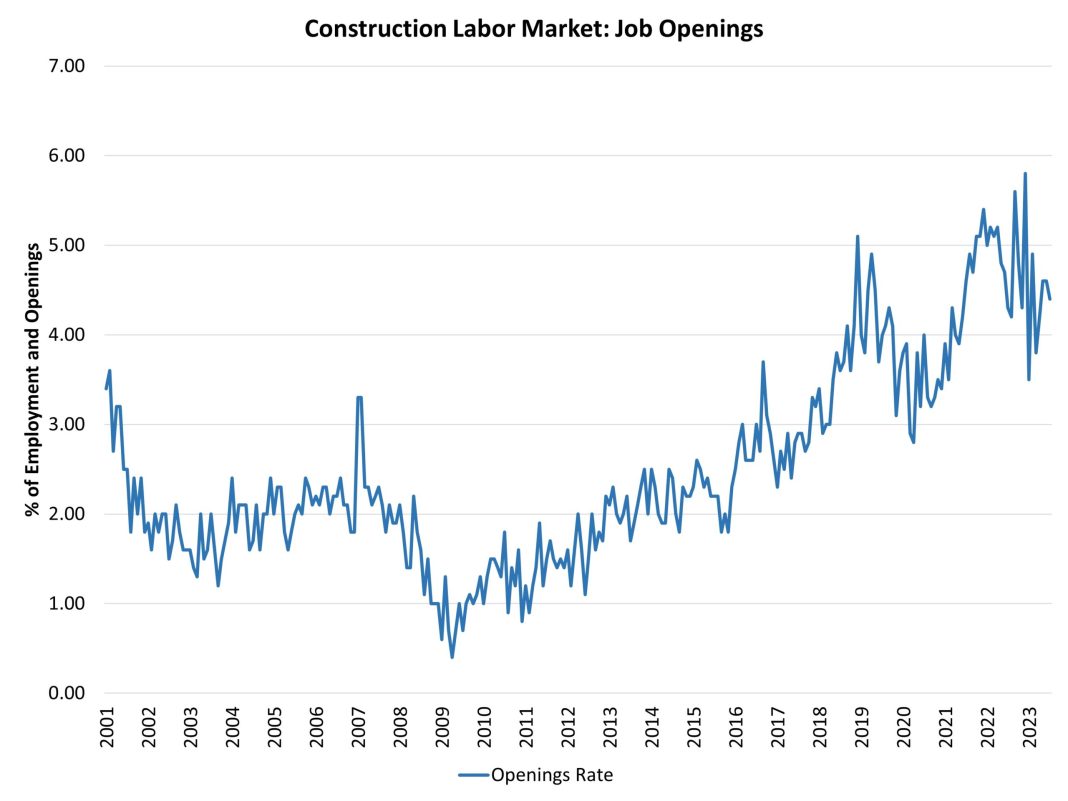

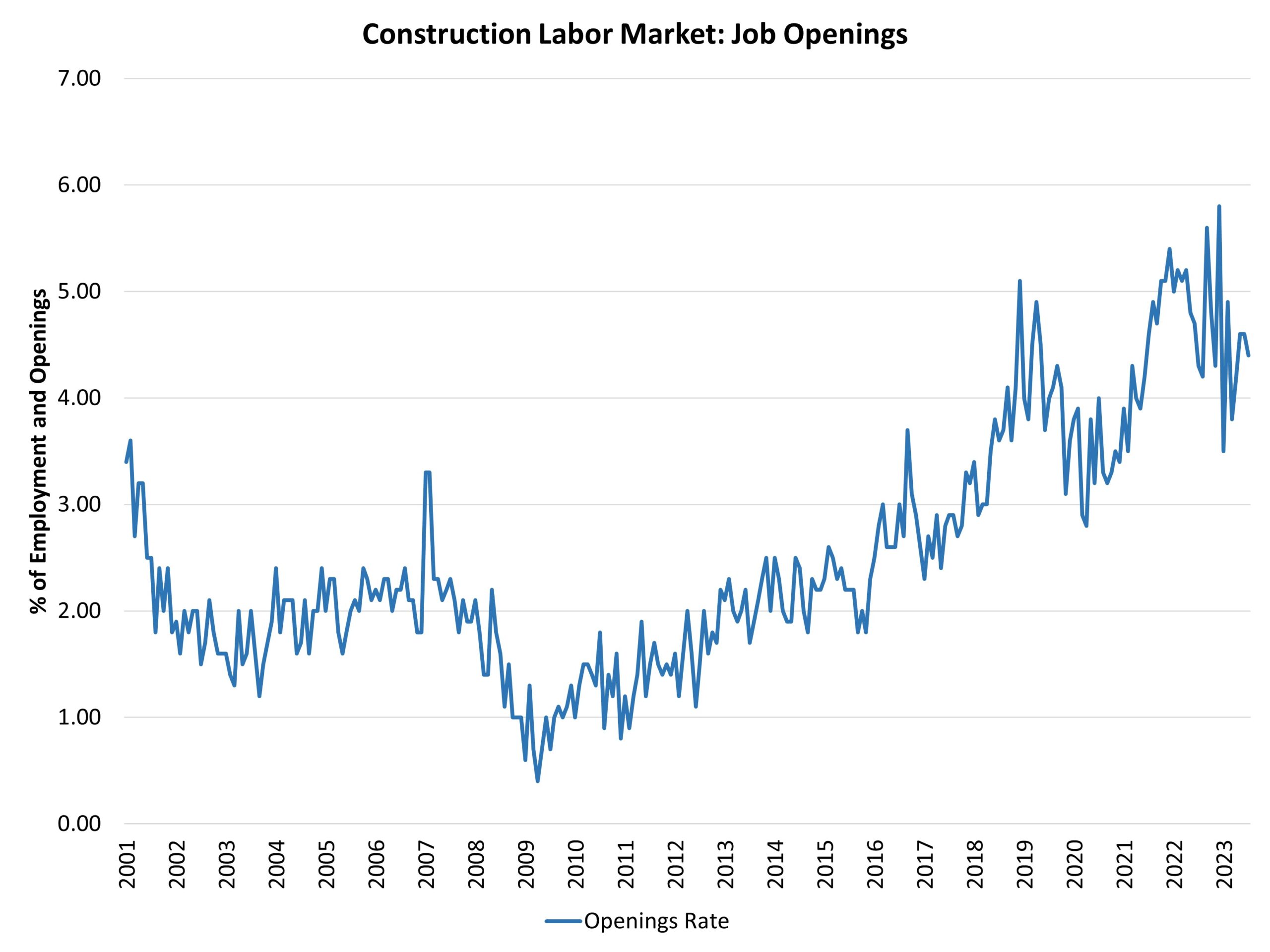

The unemployment rate has risen for four consecutive months, reaching 4.1 percent in June, the highest level since November 2021. While this rate remains historically low, it raises concerns about the labor market’s health. MacroMicro, an analytics firm, points out that labor demand has fallen to pre-pandemic levels, as measured by the ratio of job vacancies to the number of unemployed individuals. The Sahm Rule Recession Indicator, which identifies signals related to the start of a recession, is also approaching a trigger point at 0.43 percent.

Debating the Fed’s Monetary Policy:

Economists continue to debate whether the Fed’s monetary policy interventions will lead to a recession or a soft landing for the U.S. economy. A soft landing refers to a measured cooling that brings inflation back to the Fed’s 2 percent target without causing significant harm to the labor market. The potential for a rate cut by the Fed reflects their efforts to balance economic growth and stability amid signs of a cooling labor market.

Conclusion:

The recent increase in U.S. worker unemployment claims suggests a cooling labor market, potentially prompting the Federal Reserve to consider rate cuts. High interest rates have contributed to reduced consumer spending and business investment, resulting in a weakened job market. While some economists view this as a softening rather than a breakdown, concerns arise as the unemployment rate continues to rise. As the debate over the Fed’s monetary policy interventions persists, the focus remains on achieving a soft landing for the U.S. economy without causing significant damage to the labor market.