The Rising Cost of Auto Insurance: A Post-Pandemic Analysis

The Rising Cost of Auto Insurance: A Post-Pandemic Analysis

Introduction:

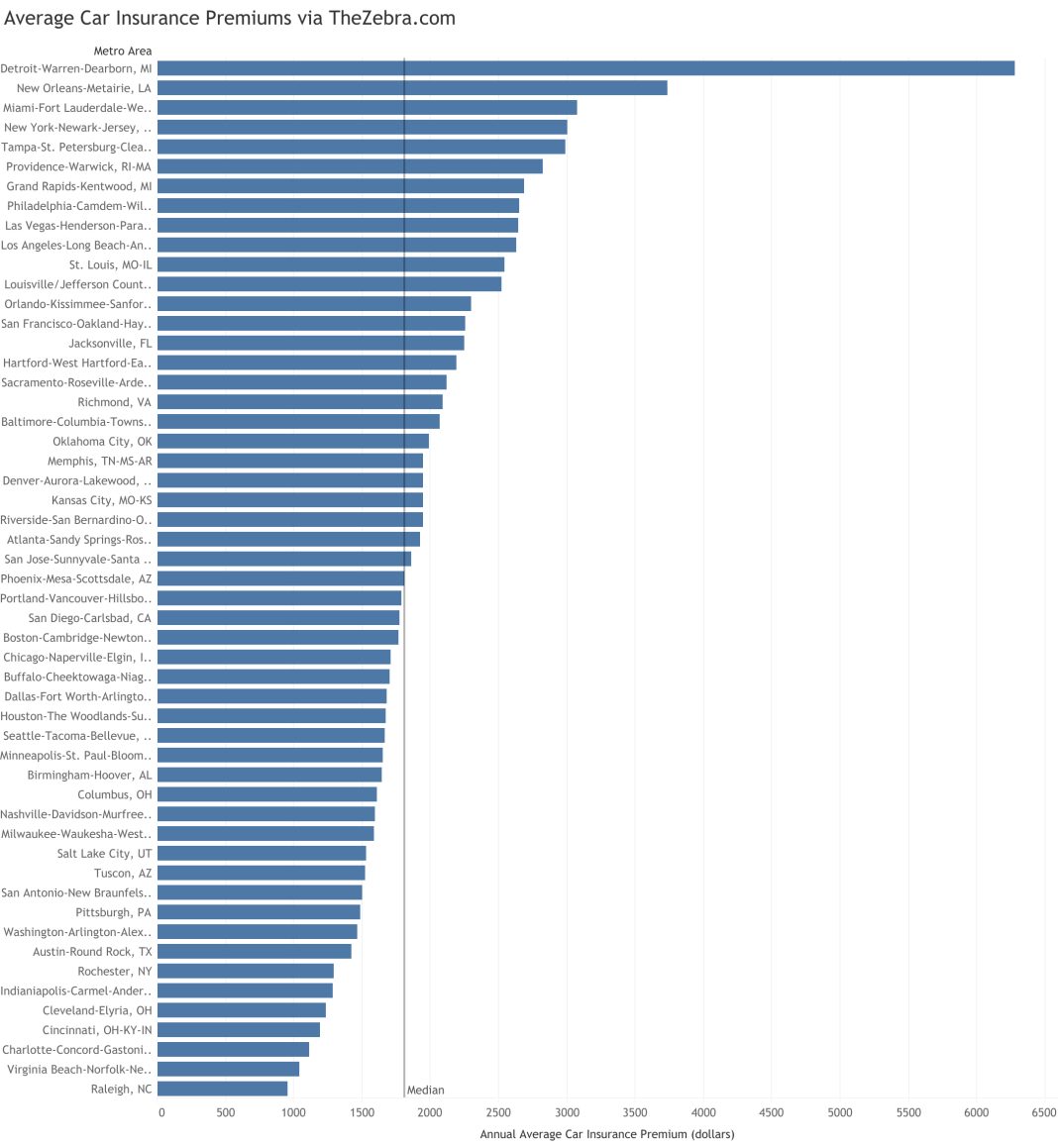

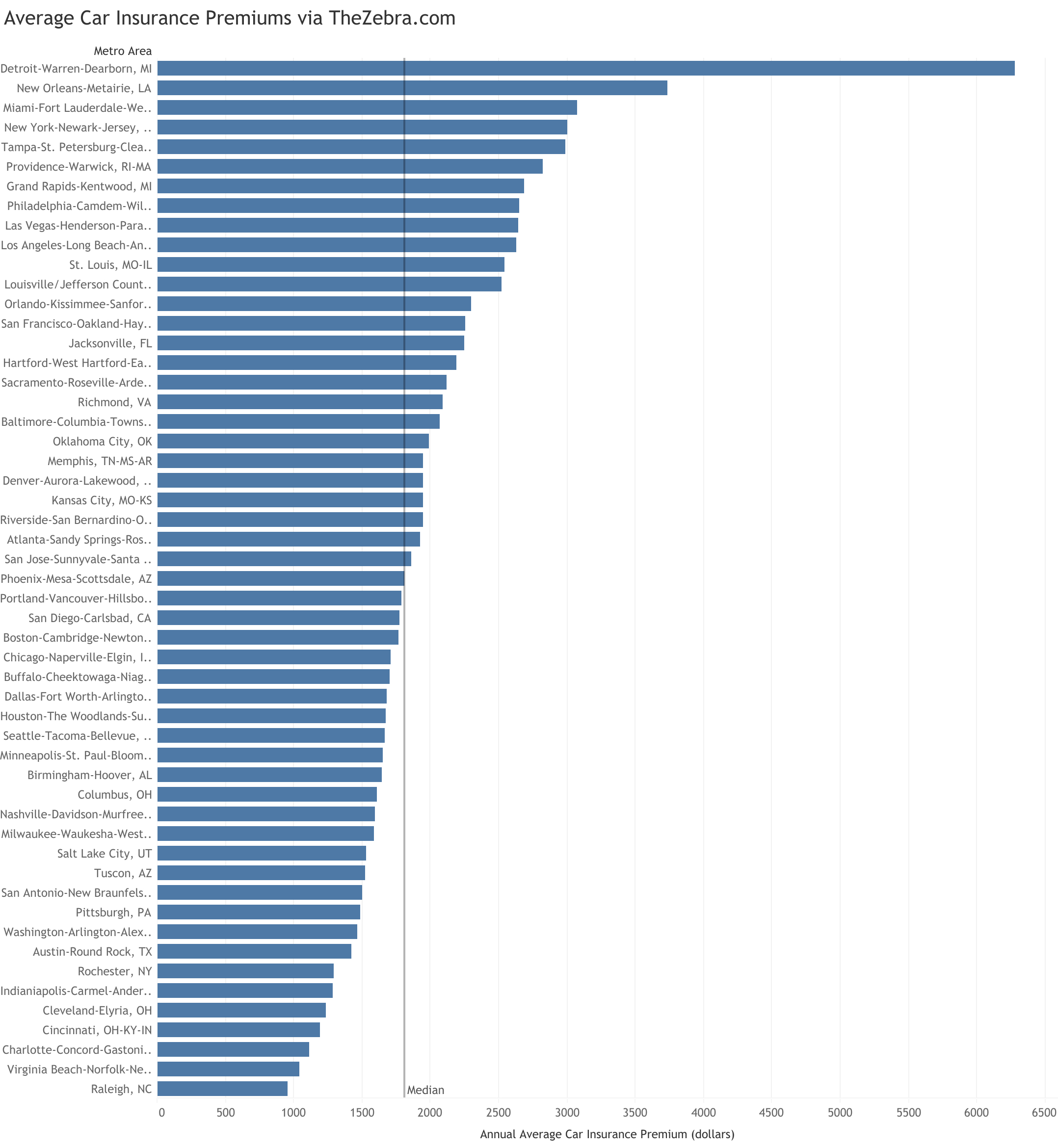

The cost of auto insurance has skyrocketed in recent years, leaving many drivers wondering why their premiums have increased so dramatically. To understand this phenomenon, we need to look back at the year 2019, which was the last relatively normal year for auto insurance, according to Stephen Crewdson, senior director of insurance intelligence at J.D. Power.

The Impact of the Pandemic:

In 2020, the COVID-19 pandemic struck, causing a significant decrease in people’s driving habits as they stopped commuting, traveling, and socializing. As a result, there was a sharp decline in miles driven and subsequently in insurance claims. Insurers found themselves with more money than they needed to pay out in claims, leading to refund checks and reduced premiums for consumers.

The Return of Drivers:

However, as 2021 rolled around and restrictions eased, drivers returned to the road, and with them came an increase in car accidents. Post-pandemic driving has become more dangerous, with more individuals speeding, driving recklessly, and becoming distracted by mobile devices and in-vehicle screens. Jeff Schlitt, owner of Schlitt Services, an independent insurance agency, highlights that distracted driving has become a prevalent issue, with drivers often looking down when they should be focused on the road.

Rising Accident Rates and Repair Costs:

The consequence of this increase in dangerous driving has been a surge in crashes and insurance claims. According to the National Highway Traffic Safety Administration, car crash fatalities rose by more than 10 percent in 2022 compared to the previous year. Additionally, repairs have become more expensive due to the advanced safety features in modern vehicles. For example, replacing a broken windshield used to cost $300, but now it can cost over $1,000 due to the technology involved.

Inflation and Supply Chain Challenges:

Auto repair shops are also facing their own challenges, including inflation, supply chain disruptions, and labor shortages. These factors have led to increased costs for repairs, which are then passed on to consumers and their insurers. Furthermore, the prolonged wait times for parts have resulted in longer vehicle rentals being necessary under auto insurance policies.

Higher Vehicle Values:

Another factor contributing to the rising cost of auto insurance is the increased value of used cars. Post-pandemic, there has been higher demand for used vehicles, leading to an increase in their market value. In the event of a total loss, most auto insurance policies pay the value of the vehicle on the day of the accident. As used vehicles are now worth more on average, insurers face higher costs when replacing these vehicles for policyholders.

The Surge in Lawsuits:

Lastly, the number of lawsuits filed after auto accidents has seen a significant increase. When drivers are at fault for an accident, they are responsible for covering the repairs and medical expenses of the injured parties. Inflationary pressures have driven up the costs associated with these lawsuits for insurers. Additionally, larger settlements for injuries have become more common, with seven-figure settlements no longer uncommon. As a result, umbrella insurance policies, which provide additional liability coverage, have also seen rising costs.

Conclusion:

The rising cost of auto insurance can be attributed to a combination of factors. The post-pandemic increase in car accidents, expensive repairs due to advanced vehicle technology, inflationary pressures, higher vehicle values, and an uptick in lawsuits have all contributed to the surge in premiums. It is essential for drivers to understand these factors and consider their options when seeking affordable coverage that adequately protects them on the road.