Illumina to Sell Grail Following Antitrust Ruling

The move came two days after a court upheld the Federal Trade Commission’s challenge to the deal on antitrust grounds.

Background

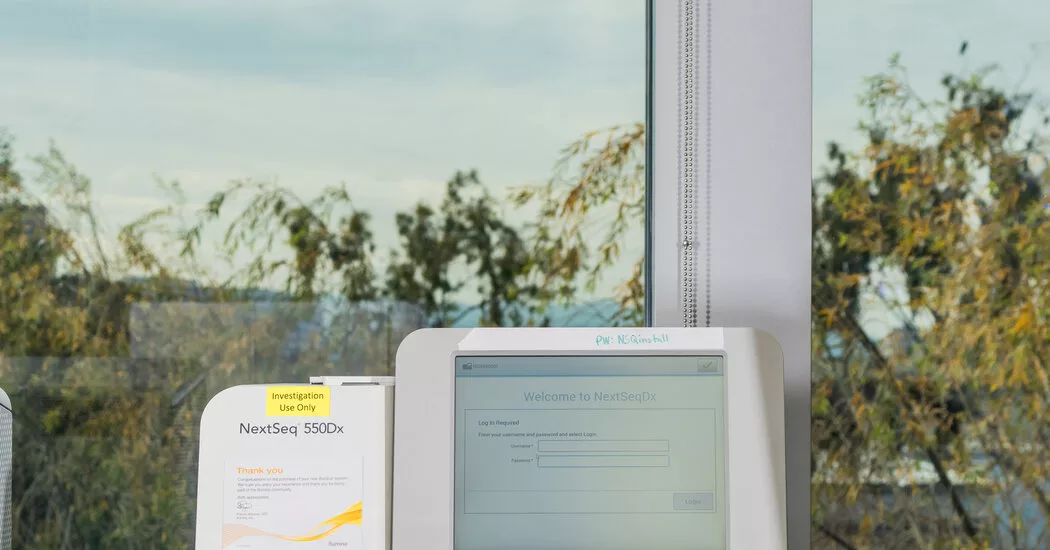

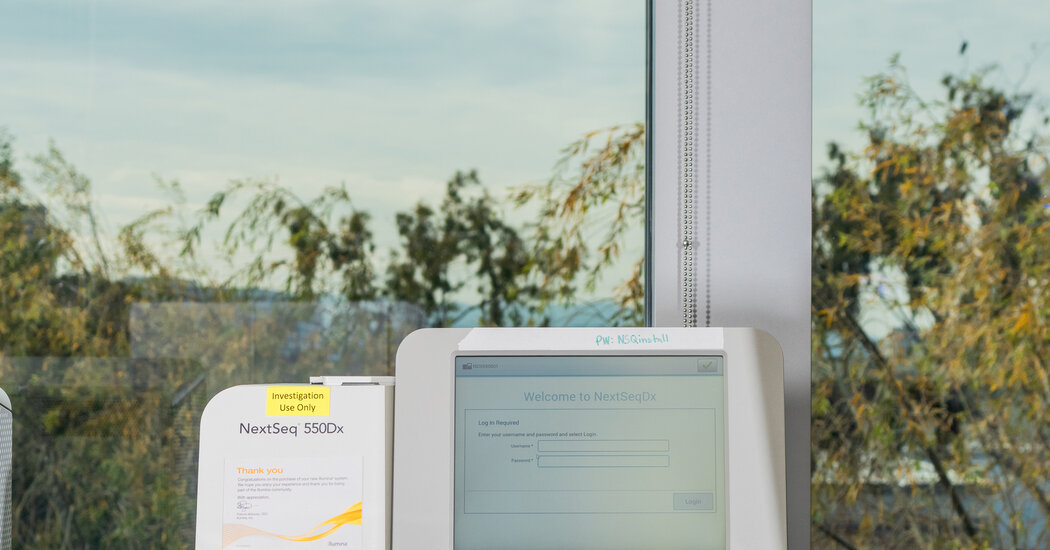

Illumina, the leading producer of gene-sequencing machines, announced on Sunday that it would sell Grail, a cancer test developer that it purchased for $7.1 billion in 2021. This decision comes after Illumina lost its case in a federal appeals court, which largely upheld a Federal Trade Commission ruling that the company should unwind its deal with Grail due to antitrust concerns.

Implications for Antitrust Regulation

The court case involving Illumina and Grail has been closely watched by antitrust experts as a test of regulators’ efforts to prevent large companies from acquiring smaller innovators. With the court upholding the FTC’s challenge, it sets a precedent that could potentially curb acquisition attempts by other tech giants and dominant companies in their respective fields.

Illumina’s Commitment to Divestiture

Illumina’s CEO, Jacob Thaysen, expressed the company’s commitment to an expeditious divestiture of Grail while ensuring that its technology continues to benefit patients. Thaysen stated, “The management team and I continue to focus on our core business and supporting our customers. I am confident in Illumina’s opportunities and our long-term success.”

About Grail

Grail, originally a research project within Illumina, was spun out as a separate company in 2016. It has developed technology for the early detection of certain cancers, utilizing gene sequencing in its blood tests. While Grail does not directly compete with Illumina in gene sequencing, the acquisition faced opposition from the FTC, which argued that it would stifle innovation and lead to increased prices in the U.S. market.

Sale Process and Timeline

The sale of Grail will be executed through a third-party sale or a capital market transaction, with the aim of finalizing the deal by the end of the second quarter next year. Illumina is determined to ensure a smooth transition for Grail while focusing on its core business and supporting its customers.

Overall, the outcome of the Illumina-Grail case highlights the FTC’s more aggressive stance toward mergers that could potentially harm the economy. As other companies navigate acquisition attempts, they may face increased scrutiny and potential challenges from regulatory agencies.