Americans are facing the burden of elevated inflation, which has resulted in high prices for essential goods. According to a recent survey by the University of Michigan’s Surveys of Consumers, consumer sentiment has declined to its lowest level since December 2023. The Index of Consumer Sentiment dropped by 3.2 percent this month compared to June and by 7.7 percent compared to the previous year.

Americans are facing the burden of elevated inflation, which has resulted in high prices for essential goods. According to a recent survey by the University of Michigan’s Surveys of Consumers, consumer sentiment has declined to its lowest level since December 2023. The Index of Consumer Sentiment dropped by 3.2 percent this month compared to June and by 7.7 percent compared to the previous year.

Joanne Hsu, the director of consumer surveys, described consumer sentiment as “stubbornly subdued.” She noted that nearly half of consumers are still concerned about the impact of high prices, even though they expect inflation to moderate in the future.

The rise in consumer prices is evident in the cost of everyday items. Since January 2020, the price of a dozen eggs has increased by 85 percent, whole chicken by 42 percent, and a pound of bread by almost 46 percent. This prolonged period of elevated inflation has put significant pressure on household budgets.

The persistence of high inflation has also affected monetary policy. Federal Reserve Chair Jerome Powell recently stated that inflation needs to decrease further before the agency can consider reducing interest rates. The current interest rates range from 5.25 to 5.5 percent. Powell expressed concerns that prematurely loosening monetary policy could negatively impact economic activity and employment.

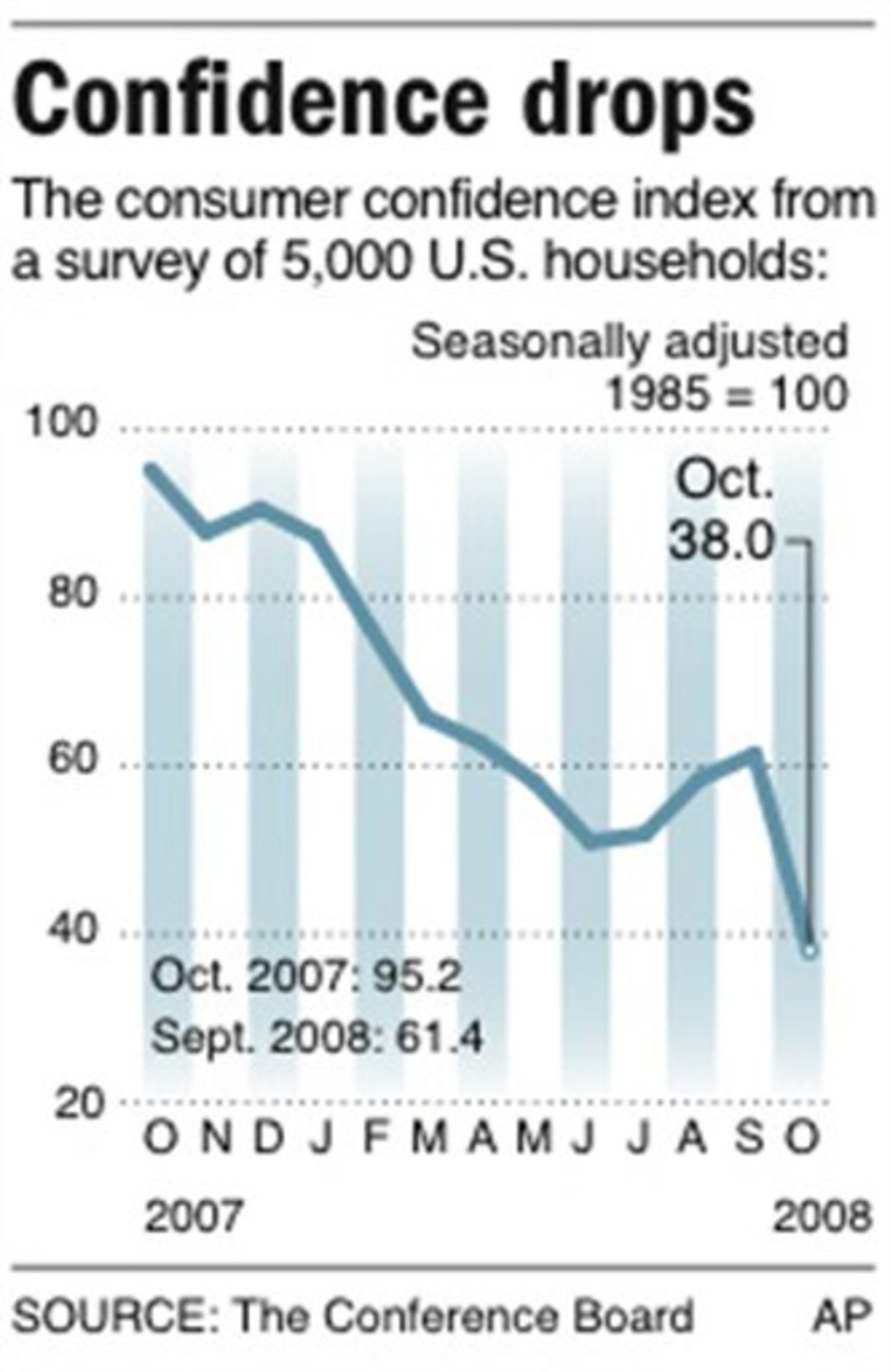

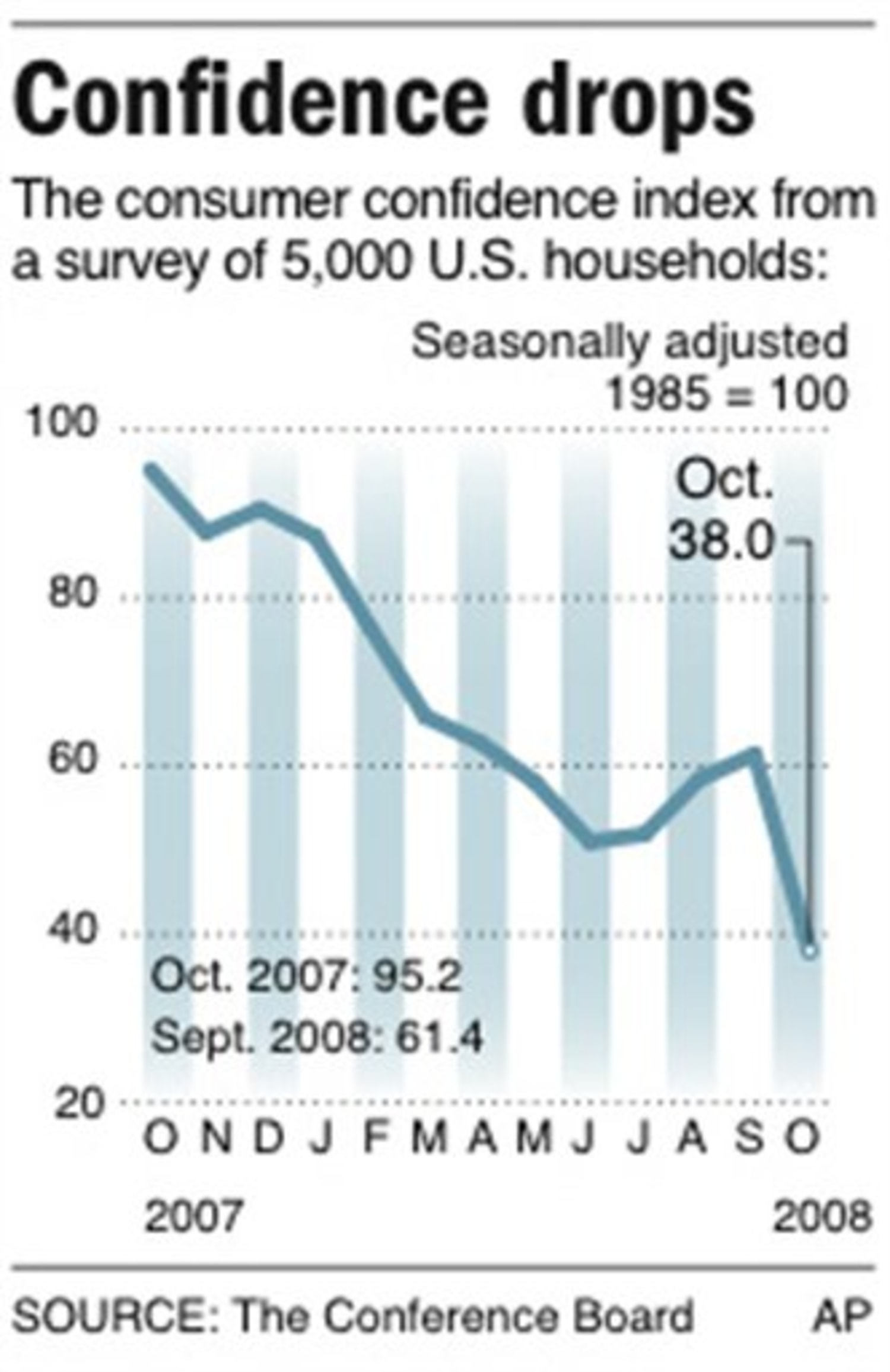

Consumer confidence is mixed as Americans assess the state of the economy. In the Conference Board’s Consumer Confidence survey, sentiments about the present labor market improved slightly, but assessments of current business conditions cooled. Expectations for future income and business conditions also weakened.

President Biden defended his policies in response to the easing inflation data for June. He highlighted falling prices for cars, appliances, and airfares, as well as wage growth outpacing inflation under his administration. However, a Gallup poll conducted in May revealed that inflation was still cited as the top financial issue by 41 percent of Americans. Additionally, a survey by Credit Karma found that more than a quarter of Americans are skipping meals due to high grocery costs, and nearly eight in 10 Americans blame inflation for difficulties in paying medical bills.

While there are early signs of relief in food prices, rising costs for necessities such as rent and gasoline may counteract Americans’ journey toward financial stability. It is crucial for policymakers and corporations to address these concerns and work towards mitigating the impact of inflation on households.