Citigroup Faces Regulatory Fines for Data Management and Risk Issues

Citigroup Faces Regulatory Fines for Data Management and Risk Issues

Introduction:

Citigroup, one of the largest financial institutions in the United States, has been hit with regulatory fines totaling $135.6 million. The fines were imposed by the Federal Reserve Board and the Office of the Comptroller of the Currency (OCC) due to Citigroup’s failure to address internal data management and risk issues. These fines highlight the ongoing challenges faced by the bank in meeting regulatory requirements and implementing effective controls.

Insufficient Progress in Resolving Data Management Issues:

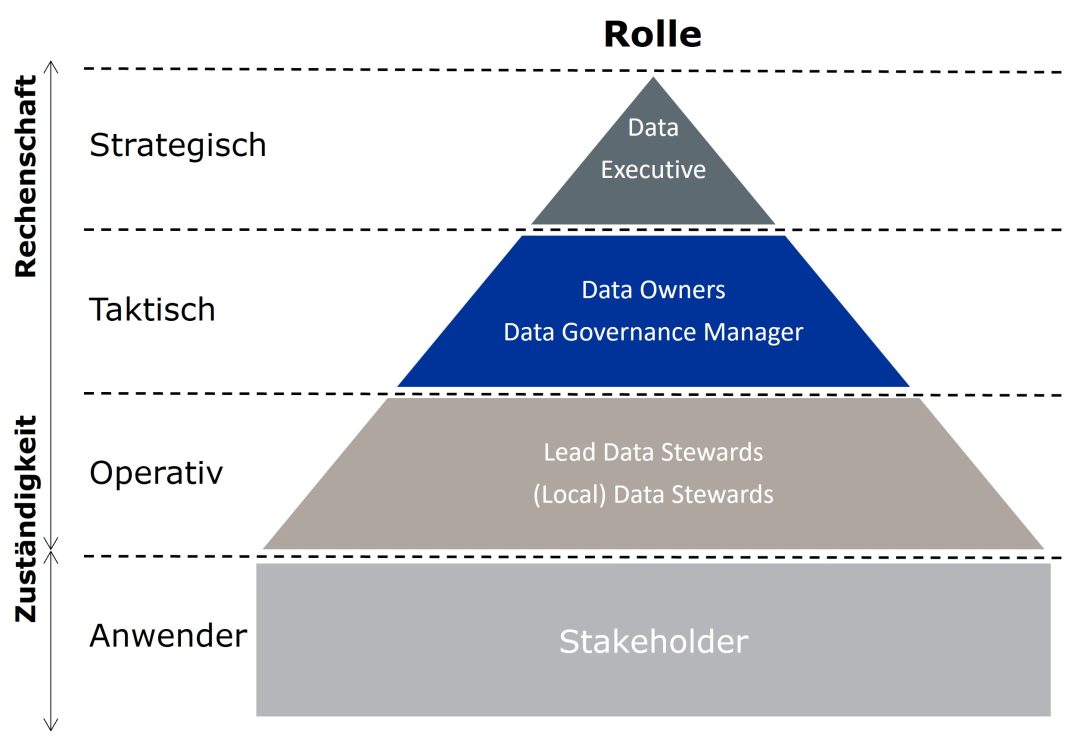

The Federal Reserve Board fined Citigroup $60.6 million for its failure to fulfill a 2020 order that required the bank to resolve data management issues and implement controls to manage ongoing risks. The board stated that Citigroup has made insufficient progress in remediating its problems with data quality management and has not implemented compensating controls to address ongoing risks. This lack of progress is a cause for concern, as it indicates a failure on the bank’s part to prioritize compliance and risk management.

Failure to Meet Remediation Milestones:

In addition to the fine imposed by the Federal Reserve Board, the OCC announced a $75 million fine against Citibank, Citigroup’s main U.S. banking subsidiary, based on the same 2020 order. The OCC cited the bank’s failure to meet remediation milestones and make sufficient and sustainable progress towards compliance. Furthermore, Citibank was found to have a lack of processes in place to monitor the impact of data quality concerns on regulatory reporting. These shortcomings reflect a systemic issue within the bank’s operations that must be addressed promptly.

Persistent Weaknesses in Data Management:

Acting Comptroller of the Currency Michael J. Hsu emphasized the importance of Citibank fully addressing its longstanding deficiencies in data management. While acknowledging that the bank has made meaningful progress overall, Hsu highlighted persistent weaknesses that remain, particularly in relation to data. This indicates that Citigroup’s efforts to transform and simplify its operations have not adequately addressed fundamental data management issues. The bank must refocus its efforts and allocate appropriate resources to rectify these deficiencies.

History of Non-Compliance:

These recent fines add to Citigroup’s history of regulatory penalties. In 2020, the bank paid a $400 million penalty to the OCC for “unsafe or unsound banking practices” resulting from its failure to establish effective risk management and data governance programs. This penalty stemmed from an incident where Citibank mistakenly sent $500 million of its own money to creditors of its client, Revlon. The recurrence of non-compliance and risk management failures raises concerns about Citigroup’s ability to implement effective controls and mitigate operational risks.

CEO’s Response and Commitment to Transformation:

In response to the fines, CEO Jane Fraser acknowledged that while the bank has made progress in addressing consent orders, there are areas where it has not moved quickly enough. Data quality management was specifically highlighted as an area that requires greater attention. Fraser emphasized that Citigroup is intensifying its focus and increasing its investment in transformation efforts. The bank is committed to allocating the necessary resources to address regulatory issues and meet its strategic and financial goals. Fraser expressed confidence in the bank’s ability to navigate these challenges and achieve its transformation objectives.

Conclusion:

The regulatory fines imposed on Citigroup underscore the ongoing challenges faced by the bank in resolving internal data management and risk issues. The lack of progress and persistent weaknesses in data management raise concerns about Citigroup’s ability to meet regulatory requirements and effectively manage operational risks. The CEO’s commitment to transformation and investment in addressing these issues is a positive step forward. However, the bank must demonstrate a tangible improvement in data quality management and implement robust controls to prevent further compliance failures. Only through proactive measures and a comprehensive approach to risk management can Citigroup rebuild trust and strengthen its position in the financial industry.