Record-breaking rally on Wall Street continues as weak reports on the economy create the possibility of interest rate cuts. The S&P 500 reached a new all-time high for the 33rd time this year, rising by 0.5 percent. However, the Dow Jones Industrial Average slipped by 0.1 percent, while the Nasdaq composite climbed by 0.9 percent to set its own record.

Record-breaking rally on Wall Street continues as weak reports on the economy create the possibility of interest rate cuts. The S&P 500 reached a new all-time high for the 33rd time this year, rising by 0.5 percent. However, the Dow Jones Industrial Average slipped by 0.1 percent, while the Nasdaq composite climbed by 0.9 percent to set its own record.

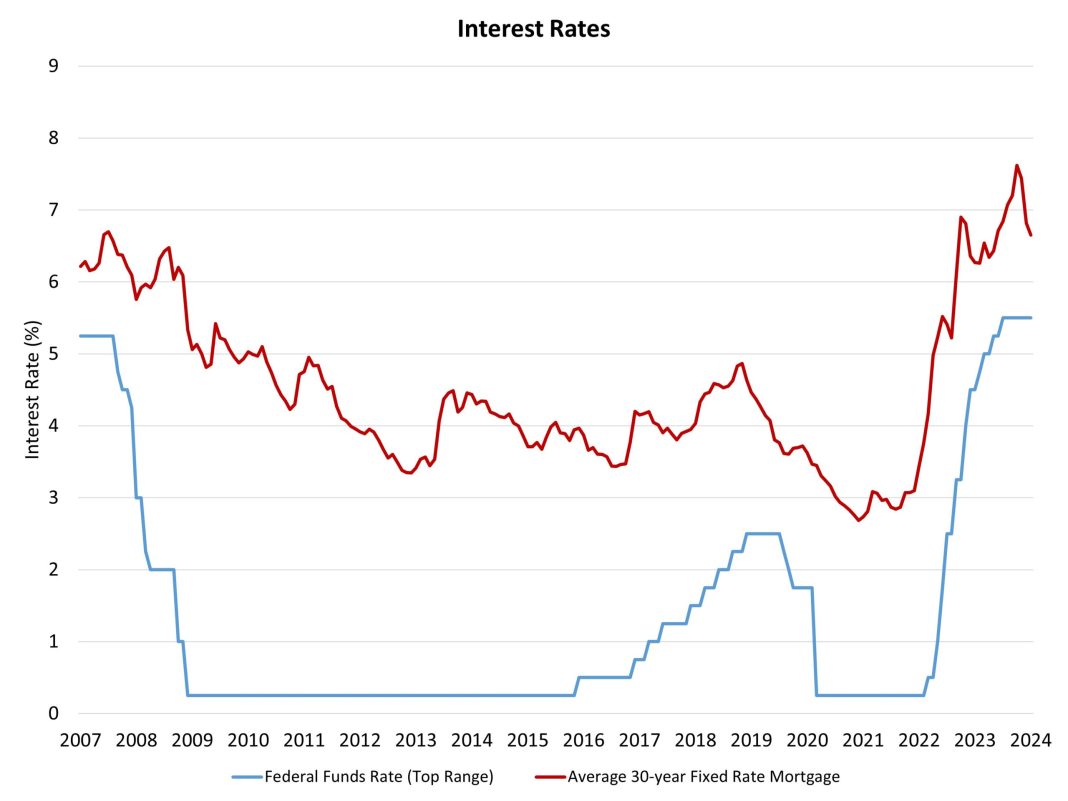

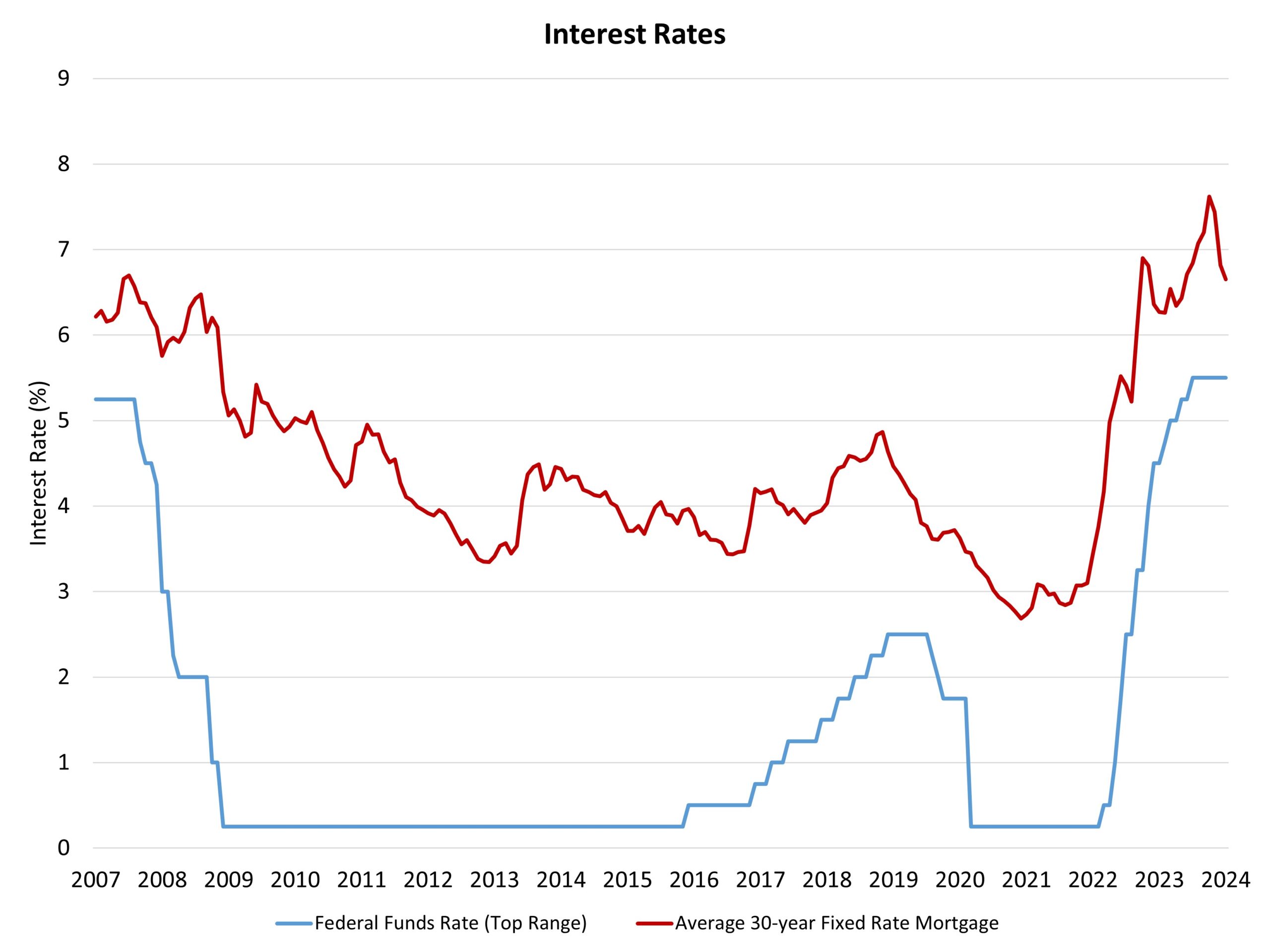

The weaker-than-expected reports on the job market and U.S. services companies played a role in pushing Treasury yields lower. These reports also increased the likelihood of the Federal Reserve cutting its main interest rate in September. This news has further fueled speculation among investors.

In Wednesday’s trading session, the S&P 500 gained 28.01 points, or 0.5 percent, closing at 5,537.02. Meanwhile, the Dow Jones Industrial Average fell by 23.85 points, or 0.1 percent, ending at 39,308. The Nasdaq composite rose by 159.54 points, or 0.9 percent, reaching 18,188.30. The Russell 2000 index of smaller companies also saw a slight increase of 2.75 points, or 0.1 percent, closing at 2,036.62.

Looking at the weekly performance, the S&P 500 has seen a gain of 76.54 points, or 1.4 percent. The Dow Jones Industrial Average has also experienced a modest increase of 189.14 points, or 0.5 percent. The Nasdaq composite, on the other hand, has surged by 455.70 points, or 2.6 percent. In contrast, the Russell 2000 index has dipped by 11.07 points, or 0.5 percent.

When considering the year-to-date performance, the S&P 500 has made significant gains of 767.19 points, or 16.1 percent. The Dow Jones Industrial Average has seen a more modest increase of 1,618.46 points, or 4.3 percent. The Nasdaq composite has had an impressive surge of 3,176.95 points, or 21.2 percent. Lastly, the Russell 2000 index has experienced a slight gain of 9.55 points, or 0.5 percent.

It is important to note that the views and opinions expressed in this article are those of the authors and are meant for general informational purposes only. They should not be interpreted as investment advice or recommendations. Readers should consult with their own financial advisors before making any investment decisions.

In conclusion, Wall Street’s rally continues to break records despite weak economic reports. The possibility of interest rate cuts has boosted investor confidence, leading to new all-time highs for major indices such as the S&P 500 and the Nasdaq composite. However, it is crucial for investors to exercise caution and seek professional advice before making any investment decisions.