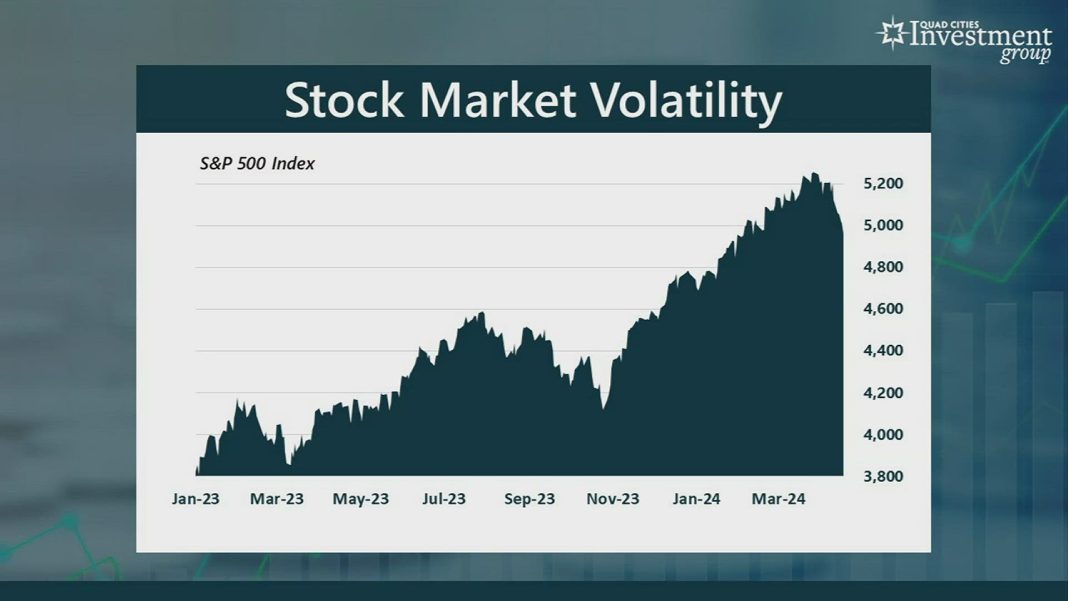

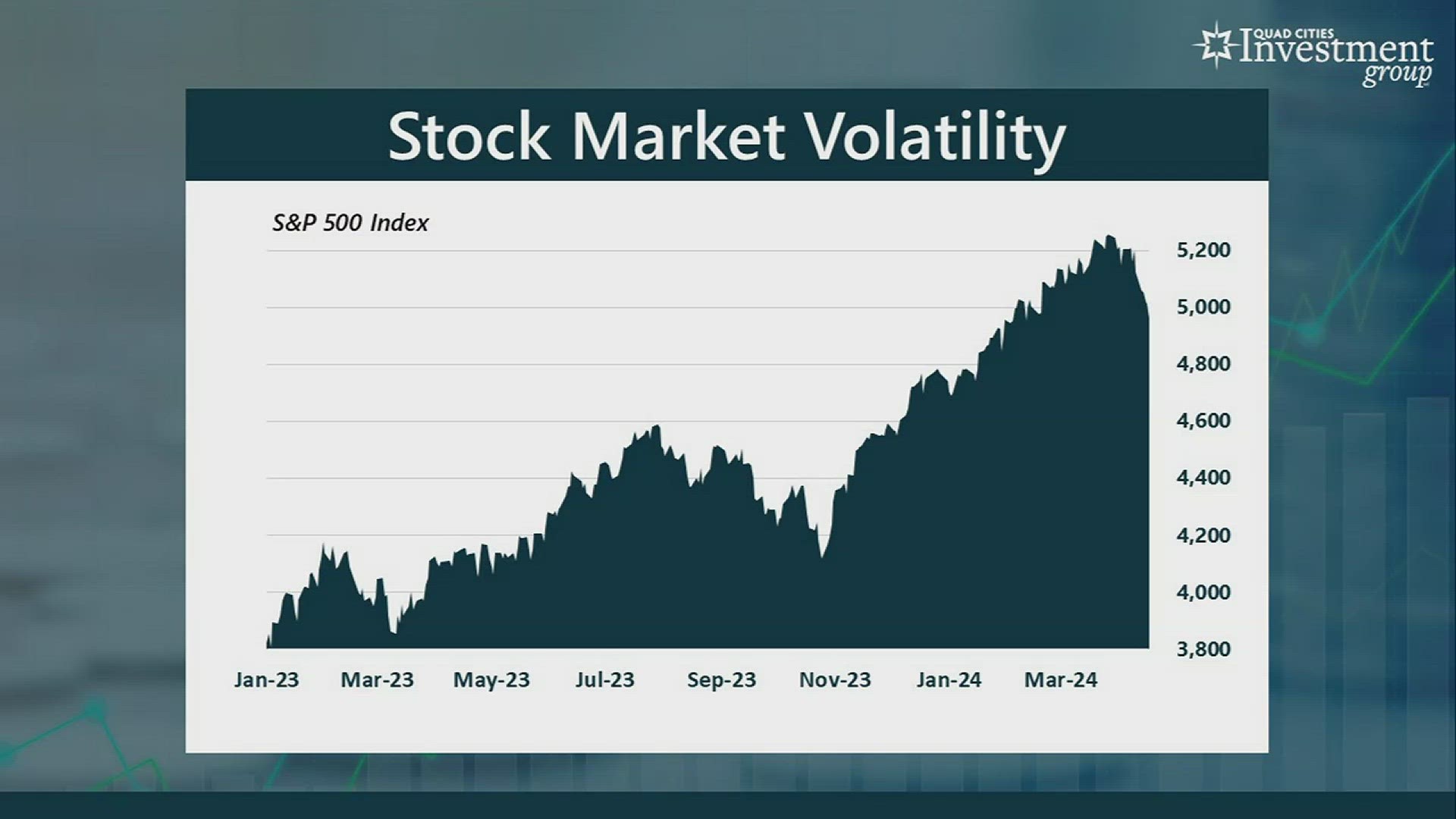

Wall Street experienced a slight setback as U.S. stock indexes retreated from their previous records, influenced by a dip in the popular tech stock, Nvidia. The mixed reports on the economy contributed to the cautious market sentiment. The S&P 500, which had reached an all-time high before the midweek financial markets holiday, declined by 0.3 percent. Similarly, the Nasdaq composite, known for its tech-heavy components, also slipped by 0.8 percent. However, the Dow Jones Industrial Average managed to outperform the market with a gain of 0.8 percent.

Wall Street experienced a slight setback as U.S. stock indexes retreated from their previous records, influenced by a dip in the popular tech stock, Nvidia. The mixed reports on the economy contributed to the cautious market sentiment. The S&P 500, which had reached an all-time high before the midweek financial markets holiday, declined by 0.3 percent. Similarly, the Nasdaq composite, known for its tech-heavy components, also slipped by 0.8 percent. However, the Dow Jones Industrial Average managed to outperform the market with a gain of 0.8 percent.

The decline in Nvidia’s stock price was a significant factor in the overall market dip. Despite initially showing promise with an early gain, Nvidia eventually fell by 3.5 percent, jeopardizing its eight-week winning streak. This decline put downward pressure on the stock market as a whole. Additionally, rising Treasury yields in the bond market further contributed to the unease among investors.

Specifically, on Thursday, the S&P 500 fell by 13.86 points, or 0.3 percent, closing at 5,473.17. In contrast, the Dow Jones Industrial Average rose by 299.90 points, or 0.8 percent, reaching 39,134.76. The Nasdaq composite experienced a more significant decline, dropping by 140.64 points, or 0.8 percent, to 17,721.59. The Russell 2000 index of smaller companies also saw a decline of 7.84 points, or 0.4 percent, closing at 2,017.39.

Looking at the weekly performance, the S&P 500 recorded an overall gain of 41.57 points, or 0.8 percent. The Dow Jones Industrial Average had a more substantial increase of 545.60 points, or 1.4 percent. The Nasdaq composite, despite its decline on Thursday, managed to secure a modest gain of 32.70 points, or 0.2 percent. Similarly, the Russell 2000 index saw a slight increase of 11.23 points, or 0.6 percent.

Analyzing the year-to-date performance, the S&P 500 has shown remarkable growth, with an increase of 703.34 points, or 14.7 percent. The Dow Jones Industrial Average has also seen positive growth, with a gain of 1,445.22 points, or 3.8 percent. The Nasdaq composite has been the standout performer, surging by 2,710.24 points, or 18.1 percent. However, the Russell 2000 index has experienced a small decline of 9.68 points, or 0.5 percent.

While the overall market experienced a setback on Thursday, it is important to note that these fluctuations are part of the normal ebb and flow of the stock market. Investors should not interpret these short-term fluctuations as indicative of long-term trends or make hasty investment decisions based solely on daily market movements.

It is always crucial to consult with a financial advisor or conduct thorough research before making any investment decisions. The stock market can be unpredictable, and seeking professional advice can help individuals make informed choices based on their specific financial goals and risk tolerance.

In conclusion, the recent dip in U.S. stock indexes, driven by Nvidia’s decline and mixed reports on the economy, highlights the inherent volatility of the market. While short-term fluctuations can cause concern among investors, it is essential to take a long-term perspective and focus on overall market performance and personal financial goals. By seeking expert advice and staying informed, investors can navigate the ever-changing stock market landscape with confidence.