Housing Market Continues to Soar, San Diego Leads the Way

Housing Market Continues to Soar, San Diego Leads the Way

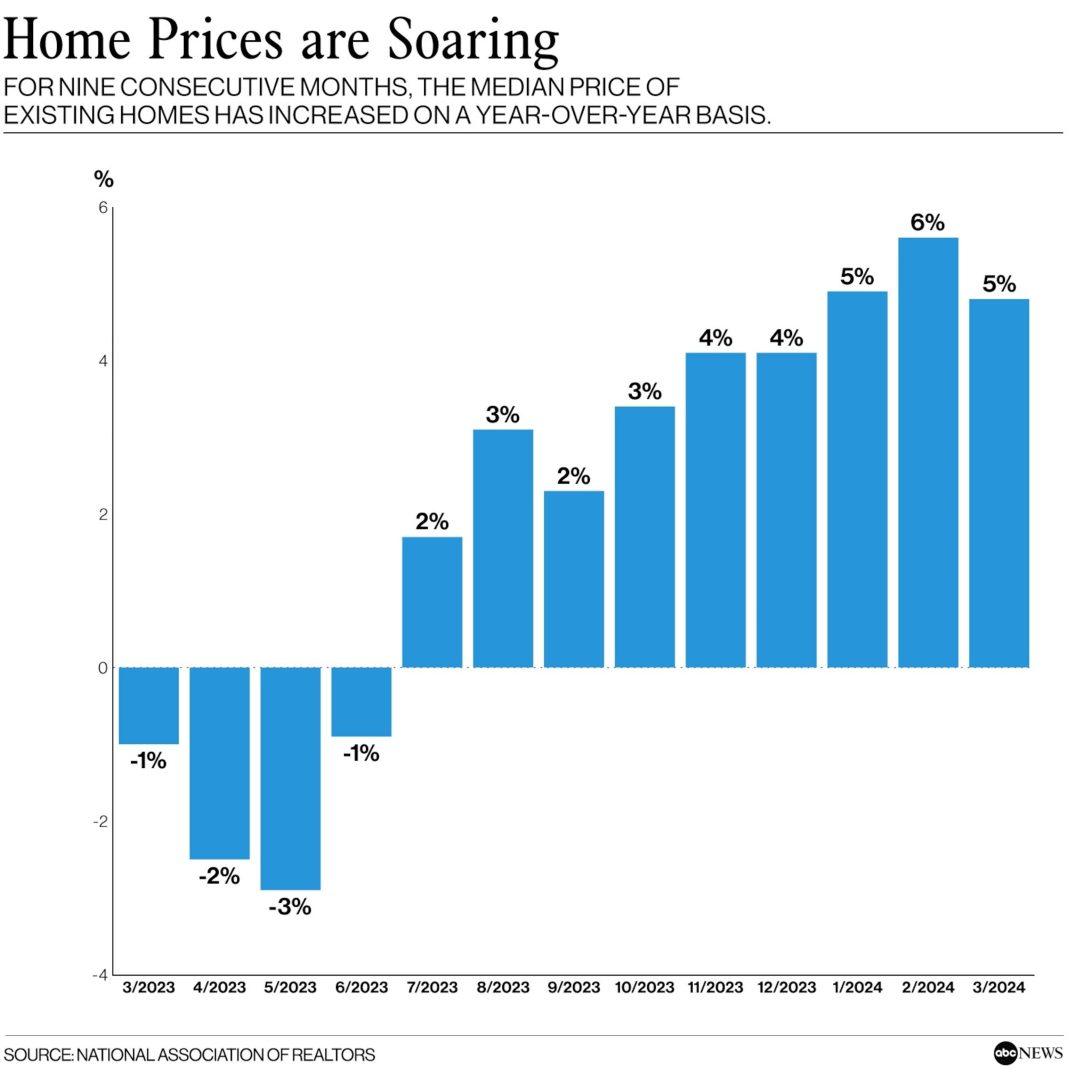

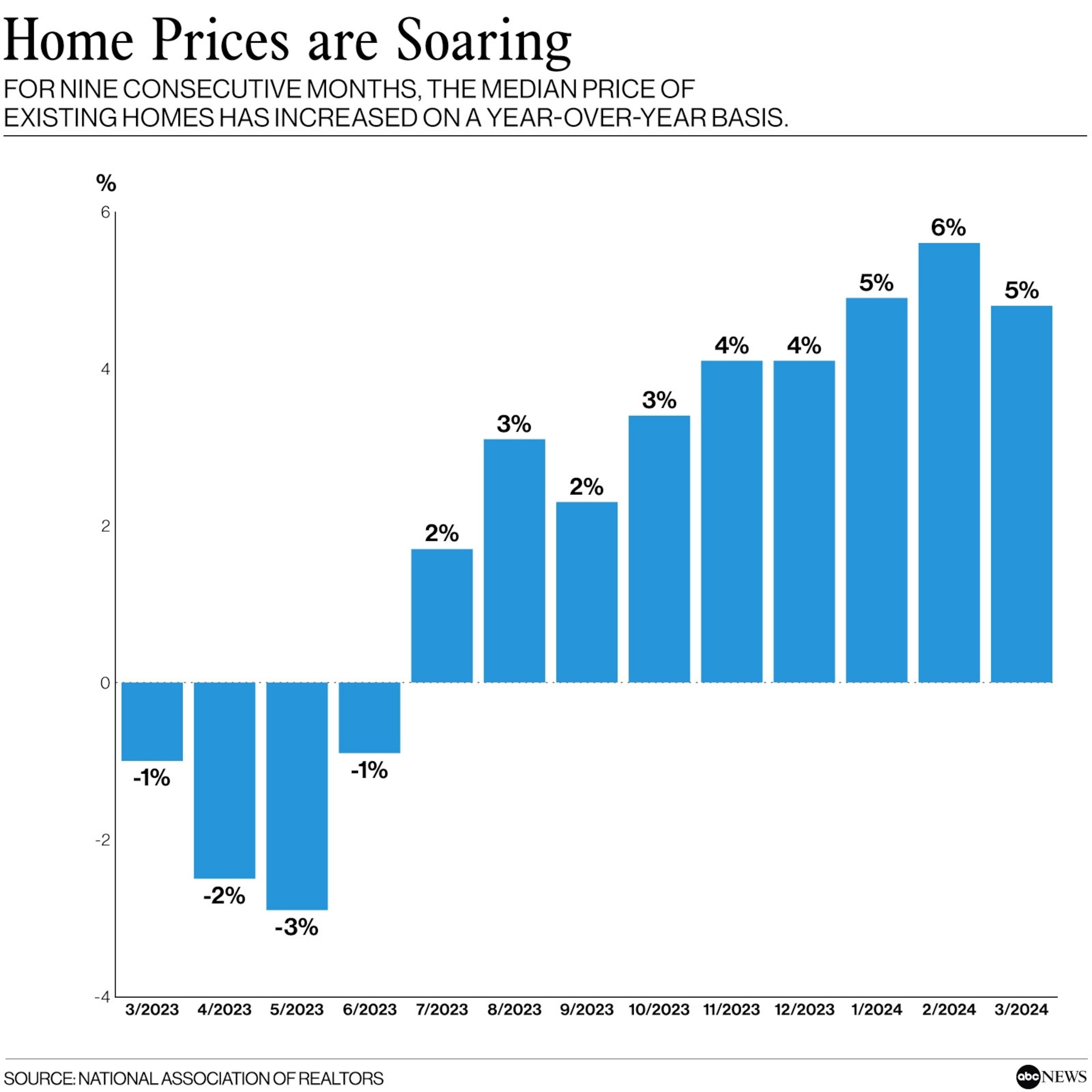

The housing market in the United States has shown no signs of slowing down, with home prices reaching a new all-time high in March 2024. According to the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, which tracks major metropolitan markets across the country, home prices rose by 6.5 percent year-over-year during this period. The 20-City Composite, which measures home price changes in major cities, increased by 7.4 percent.

Among the tracked cities, San Diego reported the highest gain, with home prices surging by an impressive 11.1 percent. New York followed closely behind with a gain of 9.2 percent, and Cleveland came in third with an increase of 8.8 percent. On the other end of the spectrum, Denver had the smallest gain at 2.1 percent.

The National Home Price Index has seen significant growth under the Biden administration, increasing by nearly 34 percent between January 2021 and March 2024. This rapid increase in home prices coincided with a spike in mortgage rates. Data from Freddie Mac shows that the average weekly rate for a 30-year fixed-rate mortgage rose from 2.77 to 6.79 percent during this period.

President Biden’s Efforts to Lower Housing Costs

In an attempt to address the rising housing costs, President Biden announced plans in March to lower housing costs for working families. These plans include building and renovating over 2 million homes, lowering rental costs, and providing tax credits of $10,000 for first-time homebuyers through legislation passed by Congress.

Strong Demand in Urban Markets

The gains in San Diego, New York, Cleveland, and Los Angeles indicate a strong demand for housing in urban markets, according to Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. Southern California has seen the highest increase in home prices on an annual basis, with Seattle and San Francisco also performing well in terms of monthly performance.

The Northeast market has remained a top performer, with prices rising by 8.3 percent annually. This region has shown robust growth compared to other metro regions, suggesting a continued demand for housing.

Slowdown in Sunbelt Markets

While Sunbelt markets like Dallas, Phoenix, and Tampa performed well during the pandemic years, they are now experiencing slower growth. Mr. Luke notes that the northern metro cities have seen the biggest gains in recent years.

Crisis in Housing Affordability

Despite the thriving housing market, high home prices and elevated mortgage rates are causing concerns about housing affordability. The National Association of Realtors (NAR) reports that buying a median-priced existing single-family home in March 2024 requires monthly payments of $2,093, a significant increase from $1,206 in 2021. The mortgage payment as a percentage of income has also risen from 16.9 to 24.7 percent during this period.

The NAR data shows that over 90 percent of tracked metros saw home price increases in the first quarter of 2024, with 30 percent experiencing double-digit increases. The shortage of housing inventory is one of the main reasons for the elevated home prices. Many homeowners are choosing not to sell their properties, feeling “locked in” by the low mortgage rates obtained during the pandemic.

Hope for Homebuyers

While the high prices may be discouraging for homebuyers, there is still hope in certain parts of the country. Redfin Economics Research Lead Chen Zhao emphasizes that buyers have room to negotiate in some areas where homes linger on the market. Sellers are willing to slash their asking prices and provide concessions to attract buyers.

Real estate agents in Las Vegas have reported sellers offering a 5- to 10-percent reduction in the list price of homes for sale. Homes that are priced below market value receive multiple offers and are sold within days, while homes priced slightly above market value tend to sit on the market for longer periods.

The Rise of Newly Built Homes

Despite the challenges in the housing market, there has been an increase in new listings in recent months. However, the number of listings remains about 20 percent below pre-pandemic levels. Redfin reports that one-third of single-family homes for sale in the first quarter of 2024 were newly built, which is slightly lower than the record high of 34.5 percent two years ago.

Buyers Looking for Single-Family Homes

Buyers are struggling to find single-family homes within their budget, as many homeowners are hesitant to sell. Those who do list their homes often demand high prices, as they have not yet accepted that prices have fallen from their peak in 2022. However, builders have a better understanding of the current market and are pricing homes fairly, offering mortgage-rate buydowns, and providing other concessions to attract buyers.

In conclusion, the housing market in the United States continues to thrive, reaching new all-time highs in home prices. While this is good news for sellers, it presents challenges for buyers in terms of affordability. However, there are still opportunities for negotiation and deals in certain areas. The shortage of housing inventory and the reluctance of homeowners to sell their properties are contributing to the high prices. Builders are playing a significant role in providing new housing options, but the demand for single-family homes remains high. Overall, the housing market reflects the ongoing economic changes and challenges faced by both buyers and sellers.