Retirement planning is a topic that everyone should consider, regardless of their age or career stage. Studies have shown that most people are not financially prepared for retirement, which could lead to a financial crisis in their later years. While there are varying opinions on how much money is needed to retire, the key factors to consider are monthly expenses, retirement debt, regular income after retirement, and tax obligations.

Retirement planning is a topic that everyone should consider, regardless of their age or career stage. Studies have shown that most people are not financially prepared for retirement, which could lead to a financial crisis in their later years. While there are varying opinions on how much money is needed to retire, the key factors to consider are monthly expenses, retirement debt, regular income after retirement, and tax obligations.

One aspect of retirement that many individuals rely on is Social Security. However, it is important to note that Social Security benefits were only designed to supplement other income sources in retirement. A shortage of funds is projected to occur in about ten years, with a predicted 17 percent shortfall expected in 2035. This projection has been pushed back by a year due to an increase in the number of people joining the workforce recently. This means that relying solely on Social Security may not be enough to cover all expenses in retirement.

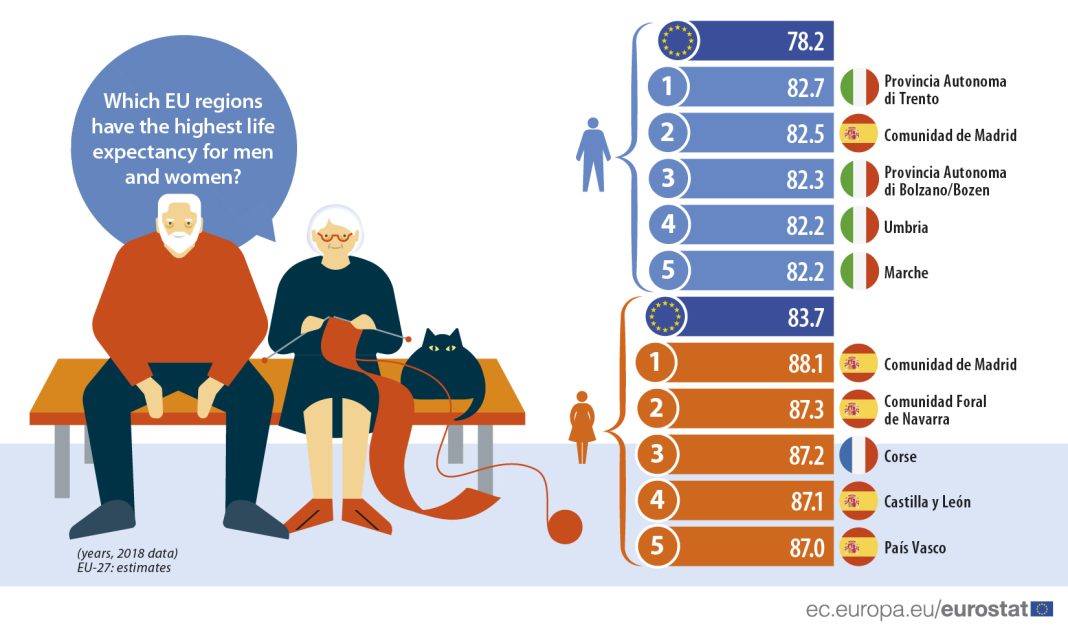

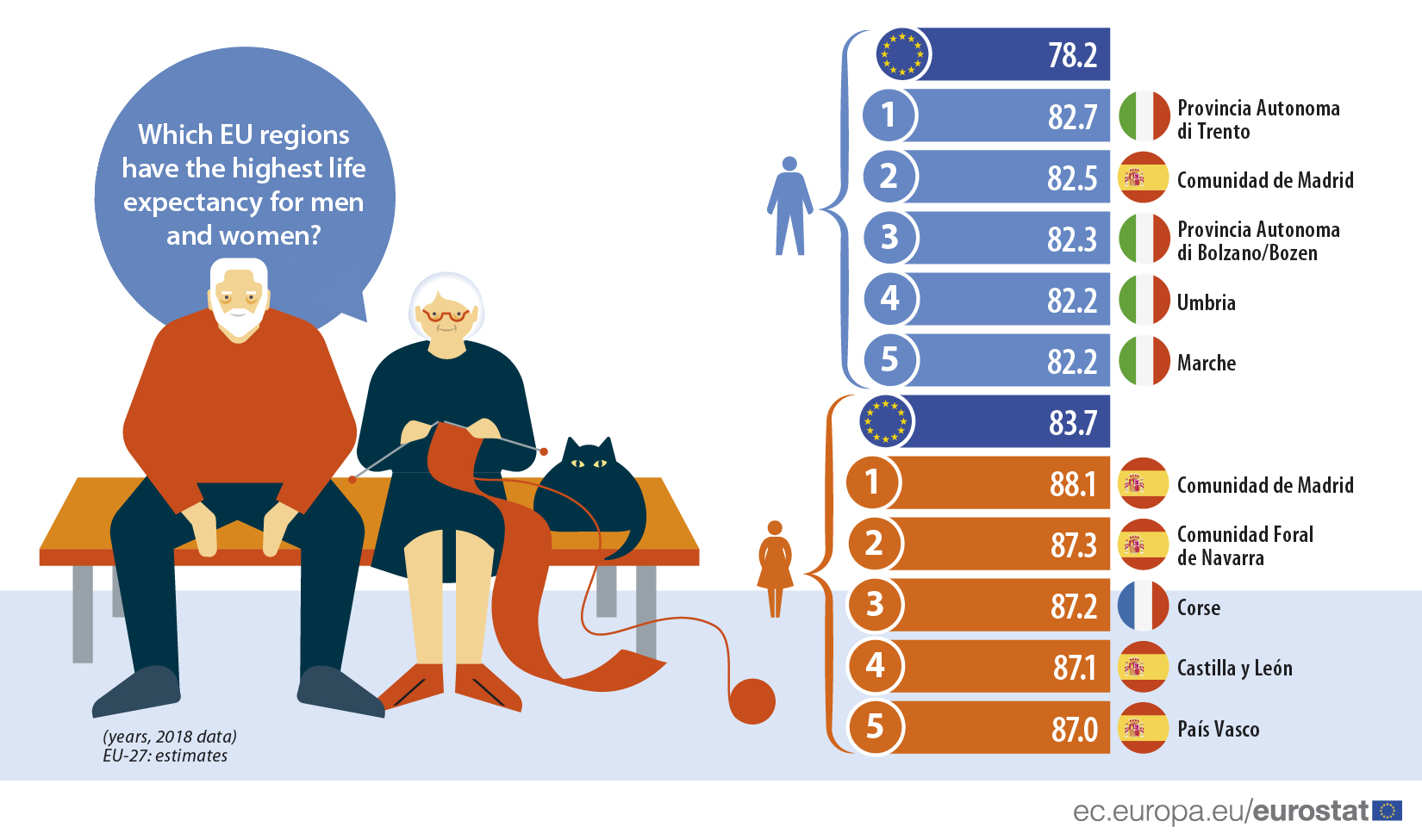

Another factor to consider when planning for retirement is the increasing life expectancy of Americans. People who retire at 65 can now expect to live into their late 70s or early 80s. Some individuals even live past the age of 100. This longer lifespan makes it difficult to accurately predict how long you will need your retirement funds to last.

Multiple surveys have revealed that people have misconceptions about what they will need or have in retirement. For example, some baby boomers mistakenly believe that Medicare will cover long-term care, when in reality it only covers short-term stays. Additionally, many people approaching retirement age are unaware of the true cost of a comfortable retirement. This lack of awareness may be why only 26 percent of workers have a backup plan in case they are forced into an early retirement.

Given the predicted shortfalls in Social Security and longer lifespans, it is crucial to start saving for retirement as early as possible. The cost of living continues to rise, with high inflation and increasing prices. Building a retirement savings plan is becoming increasingly urgent. Compound interest can significantly increase your savings over time, but it is important to act soon to ensure you have enough funds for a comfortable retirement.

There are several strategies you can employ to reduce your need for income during retirement. One of these strategies is to avoid claiming Social Security benefits too soon. While benefits may be reduced in the future, waiting to claim them can increase your overall benefits by about 8 percent per year. This can help decrease the amount of income you need from other sources.

Additionally, reducing or eliminating your debt before retirement can free up more funds for other expenses. Paying off your mortgage, car loan, and credit card debt can provide peace of mind and allow for more flexibility in retirement. Downsizing your home is another option to consider, as it can help reduce your debt and potentially save you money on property taxes.

Moving to a state with lower taxes can also help reduce your overall expenses in retirement. While it is important to carefully consider the financial implications before making a move, living in a state with no income tax or lower property tax rates can significantly impact your retirement budget.

Financial advisors are increasingly recommending that individuals save a minimum of 15 percent of their income during their working years. This can help ensure that you have a substantial nest egg by the time you retire. With $1 million saved, it is generally considered safe to withdraw 3 percent per year. This percentage has been lowered from previous recommendations due to recent economic instability and lower interest rates.

When it comes to retirement savings accounts, it is important to take advantage of any employer matching programs offered through a 401(k). Investing in a Roth 401(k) or Roth IRA can also be beneficial, as contributions are taxed upfront and withdrawals are tax-free during retirement.

In conclusion, careful retirement planning is essential to ensure a comfortable retirement. It is crucial to start saving early and consider multiple factors such as Social Security, life expectancy, and potential misconceptions about retirement costs. By reducing debt, considering a move to a state with lower taxes, and following the advice of financial advisors, individuals can increase their chances of a secure retirement. Utilize retirement calculators or consult with a financial advisor to ensure accurate estimates and receive expert guidance.